If you want to build an investment fortune over your lifetime, it is a great idea to maximize your Tax-Free Savings Account (TFSA). There is no other opportunity in Canada where you can invest and pay absolutely zero tax on your income and gains earned. Over years and decades, the money saved that would ordinarily be paid in tax could be worth a small fortune.

The TFSA is the perfect place to compound wealth

That is why every Canadian with a long-term investment horizon should consider using their full TFSA contribution space. Pair a TFSA’s tax-free benefits with investments in high-quality compounding businesses, and Canadians could truly build significant wealth. If you are looking for quality stocks to put in your TFSA, here are three that would be interesting buys today.

A top professional services stock

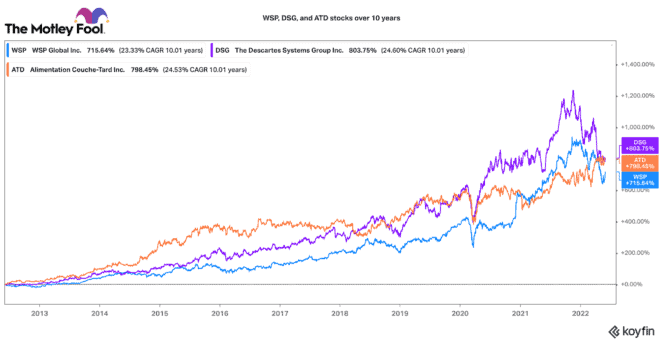

WSP Global (TSX:WSP) has been very successful at acquiring and integrating consulting/design firms into its broader platform. In fact, this strategy has helped propel the stock up by 475% over the past 10 years. With a 19% compounded annual average return, this would be a great stock for a TFSA portfolio.

WSP just announced the acquisition of the environmental and infrastructure services arm of John Wood Group for US$1.8 billion. WSP has been focused on expanding its environmental consultancy focus for years, so this deal should fit nicely into its strategic plan. Likewise, it will add over US$830 million of revenues to its business.

While this is not a “cheap” deal at 15 times EBITDA, WSP has traditionally been very good at integration. Significant synergies and cross-selling are expected. The stock market clearly liked the deal, because the stock is up over 6% on the news. WSP stock is still down 20% this year, and it looks like an attractive bargain today.

A top software stock for your TFSA

If you wouldn’t mind some growth from software stocks in your TFSA, Descartes Systems (TSX:DSG)(NASDAQ:DSGX) is one to consider. It runs a mission critical logistics network across the world. It complements this service with a broad array of transport/logistics-focused software services.

Supply chains continue to be in disarray in 2022. Demand for Descartes services should remain elevated. The company seeks to create customers for life. Once it has a customer, its services are very sticky.

Yesterday, it delivered very strong first-quarter results. Revenues were up 18%, and earnings per share were up 29%! Descartes has a resilient business model, and it is incredibly profitable. This stock is never cheap. However, it is down 27% this year, and it is trading at the low-end of its valuation range.

A top retail stock for the long term

A final stock for compounding TFSA wealth is Alimentation Couche-Tard (TSX:ATD). Frankly, its business is not overly exciting. It operates and acquires gas stations and convenience stores around the world. However, I would call a 734% stock return over the past decade fairly “exciting.”

This company has exceptional managers that are very focused on delivering long-term value for shareholders. It has completed several tuck-in acquisitions in the past year, but many analysts suggest a larger one could be on its way. In the meantime, it is accreting value by investing in organic growth and buying back stock.

Unlike the stocks above, Couche-Tard stock has held up well in 2022. Yet it only trades with an enterprise value-to-EBITDA ratio of 10 and a price-to-earnings ratio of 18. It is not ultra cheap, but for a long-term hold, it should keep growing its value for many years ahead.