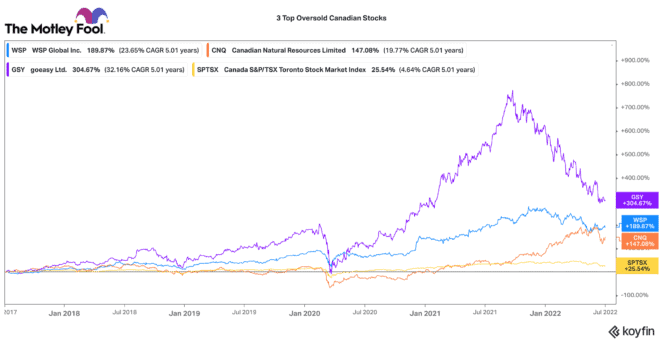

While the TSX Index is down over 10% in 2022, many Canadian stocks are down by 30% or more this year. The stock market is projecting all sorts of negative news for the economy. Certainly, we are in for some tougher times as interest rates rise to battle inflation. However, all it takes is economic factors to be “less bad” than anticipated for stocks to significantly rally.

There is a lot of bearish sentiment in the market. It is forcing down stocks in fundamentally strong businesses. As a result, shrewd and patient investors can pick up oversold stocks in great businesses that consistently create long-term value. If you can afford a long investment horizon, now is the time to upgrade your portfolio. Here are three oversold Canadian stocks I’d load up on right now.

A top Canadian dividend stock

After a strong start to the year, even Canadian oil stocks have significantly pulled back. This has created an attractive entry point to buy one of Canada’s top dividend stocks. Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is amongst Canada’s largest energy companies. Many regard it has one of the best-managed businesses in Canada.

It produces oil and natural gas with a factory-like efficiency. Over the past month, CNQ stock has fallen 15%. Today, it is paying an attractive $0.75 dividend every quarter. With a price of $72.50 a share, that equals to a substantial 4.3% dividend yield.

CNQ is generating significant spare cash with oil elevated above US$100 per barrel. This will continue to translate into ample shareholder returns like share buybacks, dividend increases, and perhaps even a special dividend. With a 10-year history of 20% annual dividend growth, this is a great Canadian stock for substantial dividend returns.

A top compounder on the TSX

WSP Global (TSX:WSP) stock has fallen 20% in 2022. This Canadian stock is now the cheapest it has been since the pandemic. Certainly, at 24 times earnings, it is hardly “cheap.” However, this is a case of paying up for a very high-quality business.

WSP is one of the world’s largest design, engineering, and consulting firms. It has offices across North America, Europe, and Asia-Pacific. It is only about to get bigger after it announced a substantial deal to acquire the environmental segment of John Wood Group.

While the deal is expected to be immediately accretive, there are also substantial synergies that WSP expects to unlock. This company has a great track record of productive acquisitions and delivering strong shareholder returns (20% compounded annual returns). The recent decline is a great way to upgrade into this top Canadian stock.

A top Canadian growth stock

goeasy (TSX:GSY) is one of the best-performing stocks on the TSX over the past five years. Yet nobody talks about it. Even though this Canadian stock is down 45% this year, it is still up 258% over the past five years. On an annualized basis that is still a massive 29% compounded annual return.

goeasy provides specialized non-prime loans and leasing services across Canada. goeasy has been able to earn significant market share in the past few years. It provides an innovative omni-channel experience and it is continually broadening its service offerings.

There are some risks that its business could be hurt during a recession. However, it has navigated several downturns in the past. Today, it only trades for 7.8 times earnings. It pays an attractive 3.7% dividend. If Canada avoids a serious recession, this stock could have significant torque to the upside.