Love it or hate it, Shopify (TSX:SHOP)(NYSE:SHOP) has been one of the most traded Canadian stocks in the last few years. This is true of Shopify stock both on the TSX and the NYSE. Clearly, the e-commerce trend was always a very intriguing secular trend. But the pandemic greatly accelerated this trend. Today, the pandemic is not the main driver in the economy anymore. It’s been replaced by inflation and a possible recession.

So, what’s next for Shopify stock?

E-commerce: A real secular trend with staying power

In the years before the pandemic, the e-commerce trend was slowly and steadily making headway. The convenience and efficiencies of online shopping are hard to beat, after all. But this rising tide was more of a slow, measured one. And even though the growth rates of e-commerce were high, this was off of small numbers. For example, in 2000, e-commerce sales accounted for a mere 1% of total retail sales.

In fact, the first time we saw the potential of e-commerce was back in the early 2000s. At that time, the benefits seemed so clear. I believed that the e-commerce industry would grow and disrupt traditional retail very rapidly.

While it did grow, the speed at which it grew was not as fast as I would have thought. This just goes to show how habits die hard — even when an alternative is a clear winner. Change is slow, but the pandemic really boosted e-commerce retail. It was out of necessity that consumers really discovered the benefits of e-commerce. And now that we’ve discovered it, there’s no turning back. In 2020, e-commerce sales increased 32%. Also, e-commerce now accounts for almost 14% of total retail sales.

With this evolution, it’s clear to see that the value proposition of e-commerce is real. For the last many years, Shopify has benefited from the shift to e-commerce.

Shopify stock: Will the return to stores be the end of this e-commerce success story?

So, we have seen how the pandemic has undoubtedly boosted Shopify’s growth profile. Growth that was expected to take years happened seemingly overnight. Today, stores are open, and consumers are back to in-person shopping. This leads us to the next issue: how much of the retail market can e-commerce take?

While this is a difficult question, I think that a change has happened and that it’s here to stay. The younger generations grew up on their phones — very tech savvy and used to everything being at their fingertips. We can assume that if e-commerce companies like Shopify play their cards right, there’s still a lot of room for strong growth.

Trouble in 2022

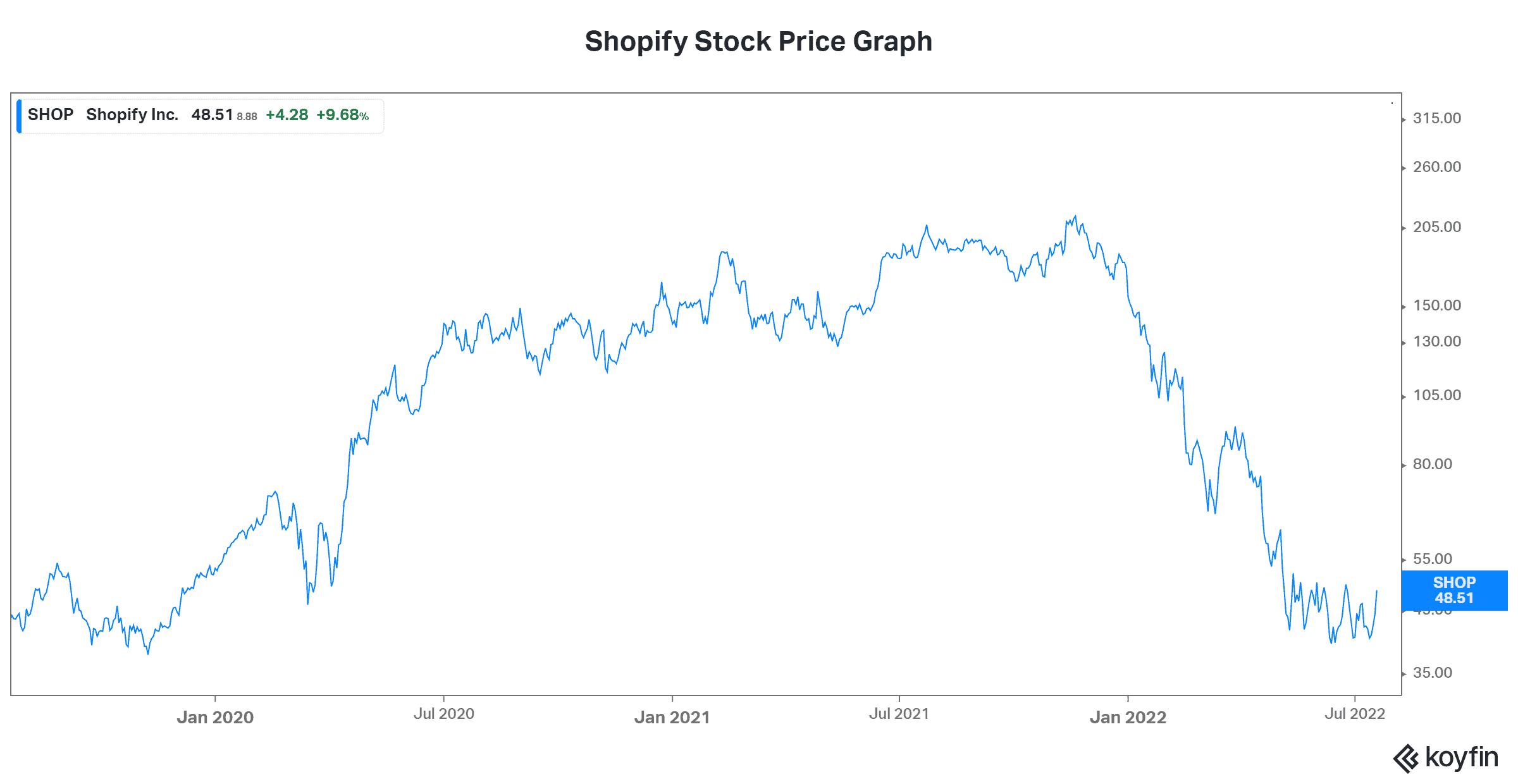

Now, let’s address the elephant in the room. Shopify has seen its stock price decimated since hitting highs in 2021 — down almost 80%. This is huge and might have you questioning whether Shopify and this whole e-commerce thing was just a pandemic phenomenon.

To this, I have a couple of things to say. First, let’s look back at the steady, strong growth that’s taken place since 2000. E-commerce retail sales have grown at a compound annual growth rate of 18% over this time. Second, let’s look at Shopify. This company has grown by enabling better e-commerce through partnerships and education. It’s created an ease of online business and transactions that has never been seen before — for both buyers and sellers.

Finally, while Shopify stock has been hit hard recently, it has rarely looked better, in my view. Its risk profile is much lower. This is because the company has proved its business model. It’s also because Shopify finally has earnings and positive cash flows. And, of course, we cannot forget about valuation when discussing the risk profile of Shopify stock. Today, Shopify still has a stock price that’s highly valued. But it’s a far cry from its prior valuations of over 100 times sales.

So, while there are many alternatives to Shopify stock on the TSX and the NYSE, it’s certainly shown that it’s best in class and worth considering.