Oil prices are sitting pretty at just under $95 today. But the Biden administration is on a mission — to send the crude oil price lower. As a result, President Biden is pressuring U.S. oil companies to increase production. He’s even gone as far as to pressure OPEC to increase production. He’s also released 180 million of barrels of oil from the U.S. Strategic Petroleum Reserve — all in an effort to drive down the price of oil.

Given this backdrop, we should be prepared. Here are three top energy stocks to hold, even if this attempt is successful and the oil price plunges.

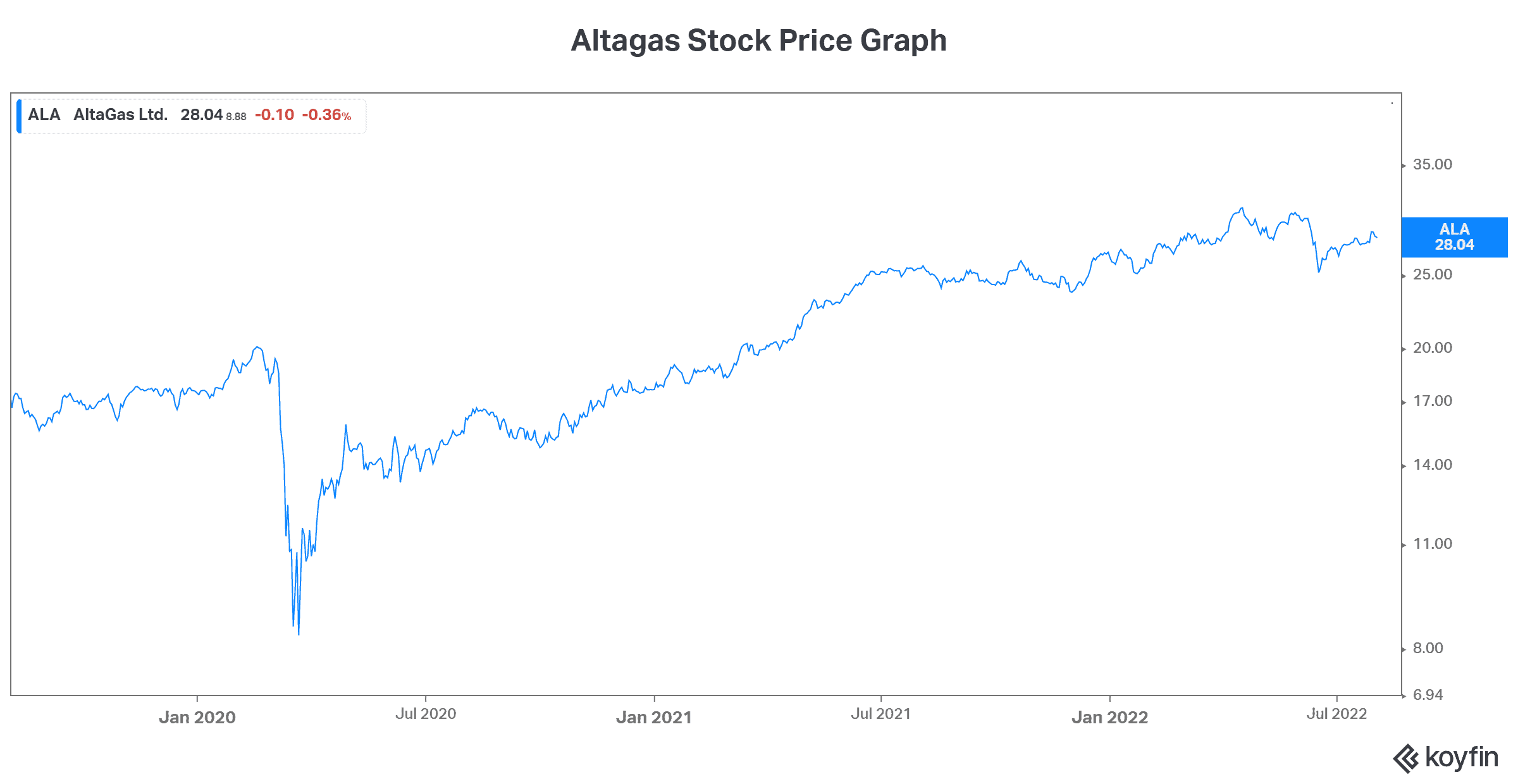

AltaGas has limited sensitivity to oil prices: It’s all about liquified natural gas

AltaGas (TSX:ALA) is a North American energy infrastructure company. It’s also one of my favourite energy stocks right now. This is because it’s really sheltered from the typical volatility that we would expect from energy companies.

Half of AltaGas’s earnings before interest, taxes, depreciation, and amortization (EBITDA) comes from its utilities segment. Since the utilities segment is highly regulated, there’s a lot of stability and predictability in these earnings. Furthermore, the other half of AltaGas’s EBITDA comes from its midstream segment. This segment focuses on the infrastructure that’s required to export Canadian natural gas globally. And this business is booming.

Liquified natural gas and its by-products are in high demand from places like Asia as well as Europe. In 2021, EBITDA from the midstream segment increased 55%. Also, AltaGas has seen its volumes of liquified petroleum gas (LPG) go from zero three years ago to 111,000 barrels a day last quarter. Last quarter, volumes increased 27% versus the prior year.

Clearly, AltaGas is in good shape to continue to thrive, even if oil prices plunge.

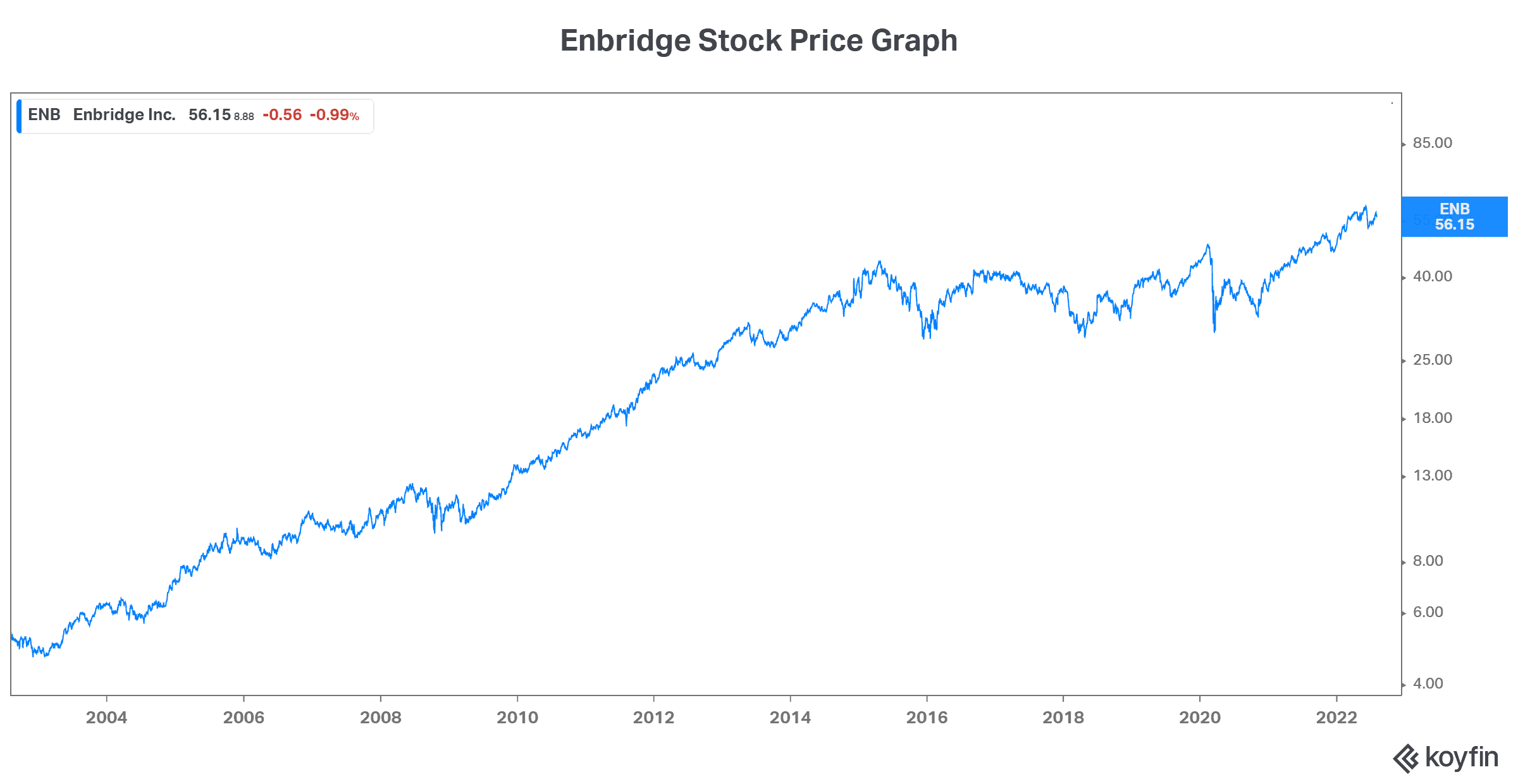

Enbridge stock: The steady and predictable

Enbridge (TSX:ENB)(NYSE:ENB) is one of North America’s leading energy infrastructure companies. As an infrastructure company, its business is relatively stable and predictable. Oil prices are important, but Enbridge’s assets and business have a long-term nature to them.

We are in dire need of Enbridge’s pipelines. As much as we’d like to deny that, it is the reality. We need only to look at the recent run-up in oil and gas prices to understand why. The lack of investment in critical infrastructure has played a large part in this. With limited pipeline space for growing oil and gas demand, we have been left in a situation of tight supply — hence the run up in the oil price.

So, Enbridge stock should fare well, even if oil prices fall. The company’s history tells us that. Enbridge has 26 years of dividend growth at a 10% compound annual growth rate (CAGR). Also, the price of Enbridge stock has been highly stable.

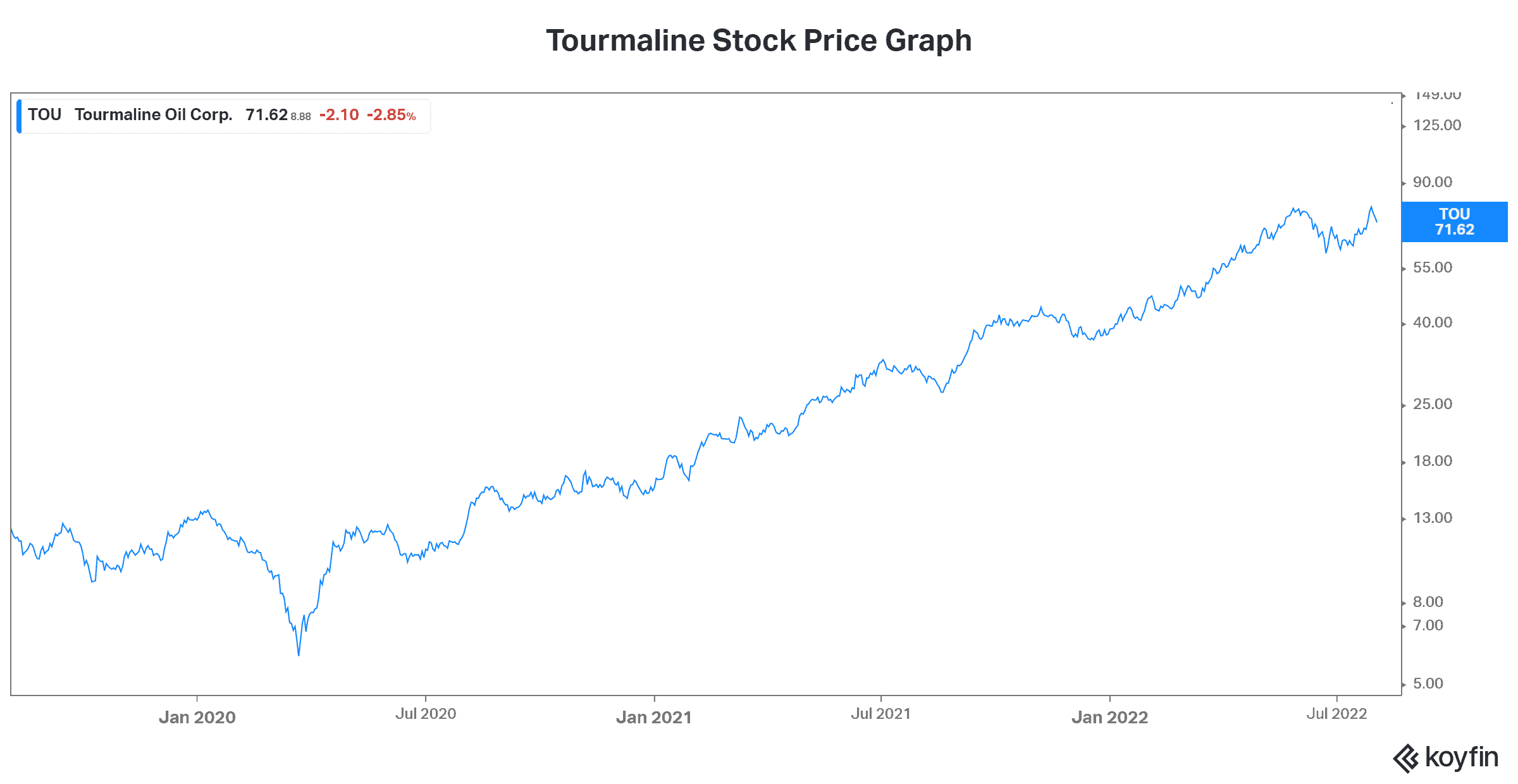

Tourmaline: An energy stock that’s immune to the crude oil price

Tourmaline Oil (TSX:TOU) is a Canadian mid-tier natural gas producer and the largest natural gas producer in Canada. Well over 90% of its production is natural gas. This puts Tourmaline in a sweet spot.

As I touched upon when discussing AltaGas, Canadian natural gas is in high demand globally. Tourmaline has long-term supply agreements that enable it to access the U.S. market. Volumes here are expected to grow 46% by the end of 2023. It also has an LNG deal with the biggest LNG exporter in the United States. The numbers here are also impressive. The deal gives Tourmaline exposure to JKM prices (the Northeast Asian LNG price), which remain quite high.

For Tourmaline, all of this this means record cash flows. In its latest quarter, Tourmaline reported operating cash flow of $1.35 billon. This was 137% higher than last year. So, what’s in it for Tourmaline shareholders? Well, a lot. Special dividends and dividend increases have been plentiful over the last couple of years. For example, Tourmaline just announced a special dividend of $2 per share. Also, the trailing 12-month dividends paid have totaled $6.28 per share. This equates to a 9% trailing dividend yield.

And we can expect this to continue and even accelerate going forward. Management plans to continue to distribute +60% of free cash flow to shareholders in 2022 and 2023. These plans are dependent on natural gas pricing, not the crude oil price.