Inflation has all Canadians worried right now, with some 60% of Canadians cutting back on groceries and entertainment, according to a new poll by Maru Group. It’s not surprising, though it took long enough, with inflation rising above 8% in June 2022.

Even if inflation starts to fall, many continue to worry about these continuously high prices. So, let me put one area of your mind at ease. Although TSX stocks are down, there are many I wouldn’t count out. In fact, these three are stress-free options for the most worried of investors.

BMO

Let’s start with an easy Big Six bank. Bank of Montreal (TSX:BMO)(NYSE:BMO) is a great option for a number of reasons. First, there are the basics. It’s a Big Six bank with provisions for loan losses, with loans having dropped thanks to rising interest rates. Further, it offers a high dividend of 4.35% — one that’s been bumped in recent months. And finally, it’s growing, making a partnership with a major French bank that will see it expand into the United States.

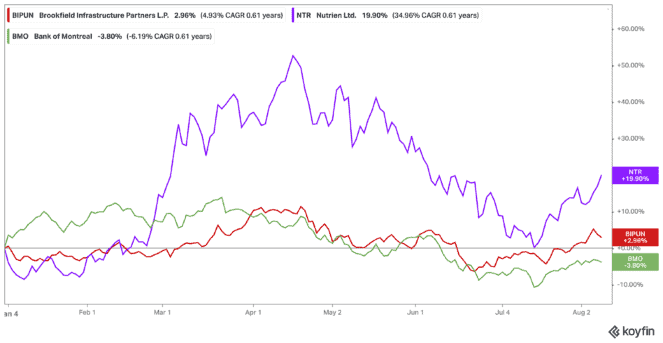

And yet this stock is cheap. As with the other Big Six, these TSX stocks are a great deal, with BMO trading at 6.98 times earnings. Shares are down 3.77% year to date, which is actually far better than the other banks. Even better, it’s up 7.8% in the last month! Since the Big Six have a history of rebounding within a year of major drops, it looks like now is the time to buy this one.

Nutrien

After a volatile start to 2022, Motley Fool investors may want to consider Nutrien (TSX:NTR)(NYSE:NTR) among their TSX stocks. Shares climbed fast with sanctions against Russia and fell almost just as fast when inflation hit. Still, we need crop nutrients, and Nutrien has been merging a fractured industry. With new deals being signed all the time, and acquisitions left, right, and centre, not to mention its e-commerce growth, this is a solid long-term play.

Yet it’s one of the TSX stocks seeing growth but that’s still undervalued. Nutrien trades at 11.32 times earnings and is down 22% since those highs in April. But in the last month, shares are back up 14%! So, Motley Fool investors can now lock in a dividend of 2.28% at a cheap price and watch this commodity stock soar.

Brookfield Infrastructure

If there’s one thing that will be around no matter what happens in the market, it’s infrastructure. Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is an excellent option for those seeking the stability of infrastructure, with the payouts of real estate. It owns infrastructure properties like pipelines and clean energy projects all around the world. And it continues to grow all the time.

Yet again, shares are down 8% since heights in April, though they remain about 2% higher than they were at the beginning of 2022. Shares have also climbed 5% in the last month, with the company experiencing a rebound that may never come to an end. So, it’s another of the stress-free TSX stocks Motley Fool investors should consider buying today — especially with a bonus of a 3.55% dividend yield.