When I say that investors have completely ignored the growth stocks I’m going to speak about in this article, I of course, don’t mean all investors. If that were the case, then these wouldn’t be growth stocks. Yet these ones seem to stay out of the headlines and yet remain great buys for those seeking growth during this rally.

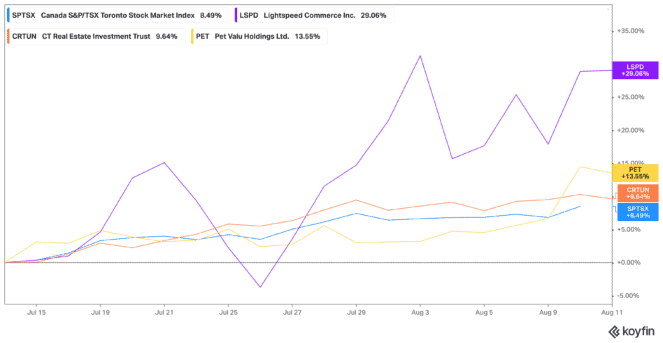

And the rally could very well continue. It’s now been almost a month since shares of the TSX started bouncing back. As of writing, the TSX today is up 8.5% since July 14. And with inflation coming down in July in the United States, it could very well be that we continue to see a strong recovery in the markets. And that means these growth stocks could rise even higher.

Lightspeed Commerce

While everyone is looking at other tech stocks, some Motley Fool investors may want to look back at Lightspeed Commerce (TSX:LSPD)(NYSE:LSPD) with renewed interest. After all, while it may be an e-commerce stock, the company has seen 30% growth since July 14. And now all of it is simply due to the rebounding market.

The company announced continued growth during its latest earnings report — growth that will merely be complemented by renewed e-commerce interest. That’s because more and more patrons to retail and restaurant locations is great for the business, too. And yet, Lightspeed stock and its share volume remains at about 712,000 daily — far lower than its 1.57 million average.

With shares up 30% in the last month, and 40% in the last three months, Lightspeed stock is one of the growth stocks I’d consider on the TSX today.

CT REIT

For those seeking value among their growth stocks, along with dividends, look to CT REIT (TSX:CRT.UN). This real estate company proved its worth during the pandemic but has come back stronger than ever on the other side. With the Canadian Tire business doing so well, and interest rates low, many stores during the pandemic renewed lease agreements. These agreements last about a decade.

The company has solid occupancy, remains strong from Canadian Tire storing its own products during supply-chain issues and is bouncing back. Even still, it remains highly valuable among growth stocks, trading at just 10.02 times earnings. And did I mention the 5.1% dividend yield?

Shares are now up 10% in the last month alone, offering those seeking growth stocks a major bump. And yet shares trade at a daily volume of 57,754, which is far below its 129,732 average.

Pet Valu

Pet Valu Holdings (TSX:PET) came out with earnings this week, and Motley Fool investors should have been watching. The company posted a strong $25.3 million in net income and boosted its annual earnings guidance. While net income is still far below where it was last year, revenue increased 25% year over year.

The company raised its 2022 outlook to between $912 and $928 million, up from $870 to $895 million. It’s a major boost, fueled by more same-store sales growth and 35-45 new store openings, the company stated. So, it’s no wonder shares have been bouncing back among growth stocks this week.

Shares are now up 14% in the last month alone, and yet it’s at about half of its daily trading volume of 52,353, down to 23,190 as of writing.