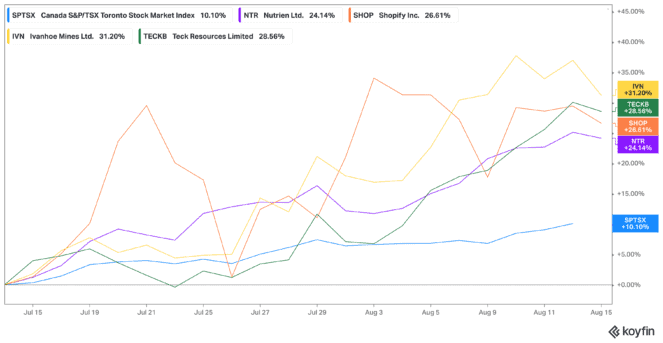

There has been a massive amount of positive movement on the TSX. The TSX is up by over 10% in the last month. While it’s still down 5% year to date, it’s now edging out of market correction territory. That leaves less of an opportunity to get in on some of the best growth stocks out there. And today, I’m going to look at four of them, each with shares up over 20% in the last month alone.

Nutrien

Nutrien (TSX:NTR)(NYSE:NTR) shares are up 24% in the last month alone, though still down from 52-week highs. This comes after Nutrien stock saw huge market movement from the sanctions against Russia. The crop nutrient and potash provider became the go-to stock on the TSX for many investors seeking growth as the rest of the markets fell.

But while Nutrien stock fell as well, shares have come back up. And yet it still trades at a valuable 7.4 times earnings offering a dividend yield of 2.09%. This ag solutions provider is a strong long-term hold, even with the recent volatility. Since we cannot make more arable land, Nutrien is a viable alternative that has managed to consolidate a quite fractured industry. Canadian investors should look to this company as a strong option among their other growth stocks.

Teck Resources

Teck Resources (TSX:TECK.B)(NYSE:TECK) is in a similarly strong position as a diversified mining stock. It offers up commodities ranging from steel-making coal to copper and silver. All these natural resources are sold by Teck no matter what the market does, as they’re necessary elements to so many industrial processes around the world.

So no wonder shares of Teck stock are up 29% among growth stocks on the TSX today. Canadian investors have been watching it for a while, attracted to the defensive aspect of this company. Yet it still trades at just 4.3 times earnings even at today’s rising prices. All while collecting a 1.14% dividend yield.

Shopify

Shopify (TSX:SHOP)(NYSE:SHOP) has also been seeing a massive rise in price after falling dramatically from its all-time high of $228 per share (adjusted for the stock split). Shares are down 71% year to date, but up 27% in the last month alone. This rebound came after the company admitted it grew too quickly, and made adjustments to bring shareholders back on board. Actions included widespread company cuts.

But, with the market rebounding, SHOP is now one of the growth stocks doing alright, at least for investors. In fact, analysts are now upgrading Shopify stock and its potential performance for the next year. Furthermore, it remains a strong long-term buy, as companies ranging from small businesses to government and financial institutions rely on Shopify to run their websites.

Ivanhoe Mines

Finally, Ivanhoe Mines (TSX:IVN) is the last of the growth stocks I’ll mention, with shares up 32% in the last month. The mining company recently reported record profits for the quarter, reaching $351.5 million in the second quarter of 2022. Its focus includes the essential mineral of copper, producing millions of tonnes of ore in the first half of 2022.

The company is now expanding into solar power, and increased the lower end of its 2022 production guidance. As it continues to expand into these necessary services, Ivanhoe stock remains at an enticing price among growth stocks. Analysts believe shares could about double this year. However, IVN does remain quite expensive trading at 143.4 times earnings. And with no dividend, this is one I’d perhaps add to your watchlist for now.