The TSX has been in recovery mode for over a month now. I know, it seems unreal, especially after not only the slowdown of 2022, but also the bumpy ride of the last few years! After recovering from the market crash of 2020, we are perhaps finally on the other side of another drop. When the market is signalling a rebound, it’s time to start looking at growth stocks.

But keep in mind. Just because there are growth stocks that have been up in 2022, doesn’t mean you should continue to hold them. And it certainly may not mean you should buy them right now. So here are two growth stocks I would buy if the TSX continues to recover, and two I would avoid.

2 growth stocks to avoid

Several industries have seen a slew of growth stocks climb higher and higher. These are industries that are inflation resistant, and offer some protection during a market drop. Now there’s nothing wrong with these companies, but it’s more that their share prices have blown far out of proportion to what they’re worth. Further, they don’t offer value to today’s investor.

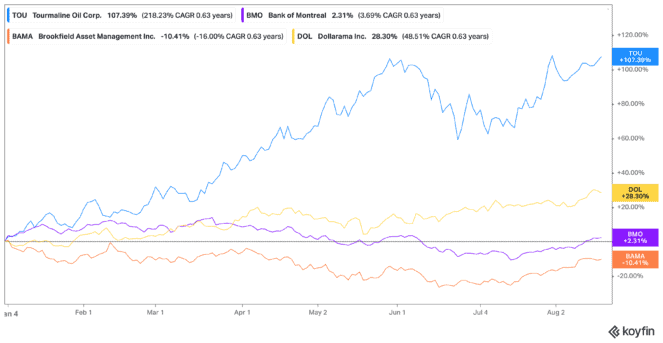

First there’s Dollarama (TSX:DOL). Dollarama stock is up 28% year to date, with shares surpassing the average target price of $79 set by analysts. Dollarama stock trades at 35 times earnings as of writing, offering little in the way of value. While the company has seen revenue and earnings growth, be warned. This could all go away once inflation is under control. As Canadians become used to the new prices of products, even Dollarama stock will have to raise its prices. Instead of digging deeper into their pockets for discount goods, Canadians may return to their previous retail stores.

Then there’s energy stocks in the oil and gas industry. These companies gained attention as the price of gas surged at the pump. Yet again, those prices have come down significantly, which I’m sure you’ve noticed. Therefore, this is not an area where I would invest. Especially in huge growth stocks like Tourmaline Oil (TSX:TOU), which has seen shares climb 107% year to date. Tourmaline stock is just too risky now for investors.

2 growth stocks to buy

At these prices, what I would recommend is buying up long-term growth stocks. And there are several you could consider. However, if you want safety and security along with growth, here are the two I would recommend.

First, there’s a Big Six Bank. I would recommend Bank of Montreal (TSX:BMO)(NYSE:BMO) above the rest for a few reasons. It has a super high dividend yield at 4.12%. It trades at a super low price-to-earnings (P/E) ratio of just 7.4. And finally, it’s been growing even during this market downturn thanks to provisions for loan losses. BMO stock now has operations in the United States after purchasing from BNP Paribas. So it offers growth there too, especially as BMO stock is up only 2.3% year to date, and 14% in the last month.

Then there’s real estate, and for some diversified growth I’d look to Brookfield Asset Mangement (TSX:BAM.A)(NYSE:BAM). Shares continue to rise higher, but dropped with the rise in interest rates and inflation. Yet the company has a very diversified portfolio with long-term lease agreements, so investors shouldn’t be worried. In fact, it achieved record inflows of $56 billion during its latest quarter – all while offering a 1.07% dividend yield, and growth of 17% this month. Yet it’s still down 10.5% year to date.

Bottom line

Don’t be fooled by all the rising numbers. Find long-term holds you can be sure you’ll want a decade from now. When it comes to Dollarama and Tourmaline stock, I’m not sure that’s the case. But BMO and Brookfield are two growth stocks you’ll be happy to hold for decades.