Like it or not, a regular passive-income stream is not an easy thing to achieve. It takes time, patience, and most of all, the right investments. For example, only the right dividend stocks can set you up for a lifetime of passive income.

Without further ado, here are two oversold dividend stocks to buy for a head start in setting up your passive-income stream.

Barrick Gold: This gold stock has been hit hard

As the world’s biggest and most well-known gold company, Barrick Gold (TSX:ABX)(NYSE:GOLD) is one of the top dividends stocks to buy for passive income. I say this because gold and gold stocks have proven to be reliable inflation hedges, or protection, throughout the years. When inflation rises, gold prices rise. And when gold prices rise, gold stocks rise.

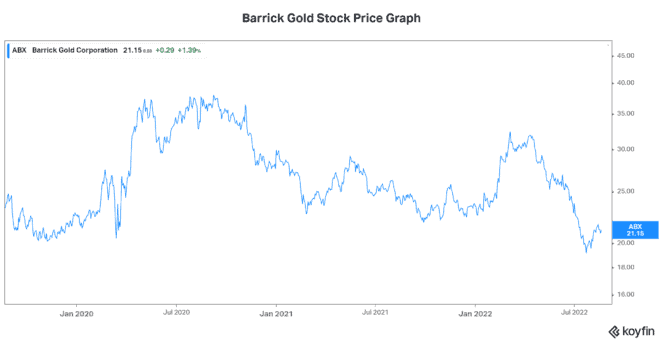

But Barrick Gold stock has been hit hard, as gold stocks have been out of favour for a long time. The graph below illustrates this.

Ironically, this is happening at a time when inflation is soaring. In fact, Canada’s June inflation rate came in at over 8%. The price of gold is sitting at roughly the same level as last year. But, with inflation eating away at the value of the dollar, the stability of gold should finally become more appealing. This will benefit Barrick Gold’s bottom-line results. It’ll also benefit the sentiment toward the stock, which is now trading in value territory.

Cryptocurrencies have interfered with the perceived value of gold in more recent times. Some have even declared that cryptocurrencies should and would replace gold as the ultimate store of value. Today, Bitcoin, the ultimate cryptocurrency, is trading at approximately $28,000. This is 56% lower than one year ago and more than double what it was in 2020.

In my view, this volatility disqualifies cryptocurrency as a reliable store of value. Instead, it renews faith in gold as the most attractive inflation hedge. Barrick Gold stock can provide this inflation hedge. It can also provide investors with a 2.5% dividend yield, setting us up for reliable passive income.

Freehold Royalties: 7.85% yield plus exposure to a booming industry

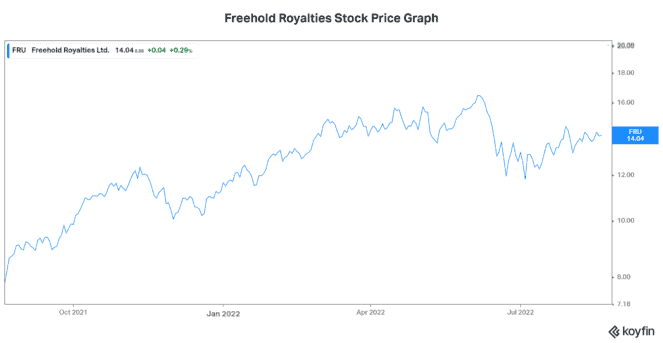

Freehold Royalties (TSX:FRU) is a Canadian oil and gas company engaged in the production and development of oil and natural gas. Today, it’s oversold — yielding a spectacular 7.85%, as the company continues to benefit from strong oil and gas prices. In its latest quarter, cash flow increased 109%. Furthermore, its quarterly dividend was increased 140% to $0.24 per share.

The valuation of Freehold stock, which is down 16% from its June highs, is also looking attractive and oversold. This is despite the fact that Freehold’s earnings and cash flows are booming. One can only conclude that the weakness in Freehold Royalty stock is a reaction to the volatility in oil and gas prices. But at today’s $89 oil, which is far below highs of +$120, Freehold still generates impressive cash flows.

We are in the midst of a strong oil and gas up-cycle that’s being driven by years of underinvestment. The supply issues are significant. And they’re not going away anytime soon. It takes years to build infrastructure, and it takes time to rebalance a market. Today, Freehold Royalties, along with many other oil and gas companies are well set up to provide their shareholders with solid passive income.