Market corrections can be great times for Canadians to turn TFSA (Tax-Free Savings Account) or RRSP (Registered Retirement Savings Plan) contributions into outsized, long-term gains. Why?

Well, high-quality stocks get marked down, and investors get an opportunity to upgrade their portfolios. When bearish market sentiment improves, these are often the quickest stocks to soar again.

Use a TFSA or RRSP (or both) to grow your wealth over time

Since high-quality stocks tend to outperform over long periods, it is best to hold these in a tax-efficient, registered account. With the TFSA, you can earn income and capital gains completely tax free. With the RRSP, you get a tax refund on contributions and the opportunity to defer tax to a later date.

If you want to build wealth over long periods, you need to maximize the effects of compounding on all your returns! Using both accounts can be a tax-efficient way to maximize total returns over the longer term.

If you are just starting out, here is how $40,000 invested in a TFSA or RRSP could grow to $850,000 or more, given enough time. Here are two top stock picks that could help you get there.

WSP Global

WSP Global (TSX:WSP) is an under-the-radar TSX stock that has quietly been delivering excellent shareholder value for years. Through strong organic growth and smart acquisitions, it has become a leading engineering, architecture, and consulting business around the world.

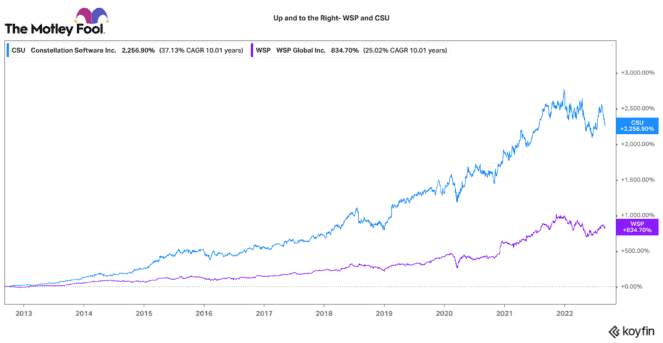

Over the past 10 years, it has earned a 21% average annual return (or 435% in total). The exciting part is that returns have accelerated to a 25% annual return over the past five years.

This year, WSP has already made three very large acquisitions in the environmental consulting space. Environmental now makes up a large part of its business. Given concerns about energy and climate change, this should drive strong growth for several years to come.

Let’s say WSP maintains a 20% average annual return going forward. If you put half your TFSA or RRSP ($20,000) into WSP stock, it could be worth $123,000 in 10 years and $308,000 in 15 years!

Constellation Software

Constellation Software (TSX:CSU) is a great technology stock for long-term RRSP or TFSA investments. Its strategy to consolidate small vertical market software businesses around the world has driven astounding 34.75% annual average returns over a decade. That equates to a 1,874% total return!

Constellation is not a cheap stock, but it has pulled back 16.4% this year. Historically, any major pullback has been an excellent buying opportunity.

This company is incredibly focused on smartly compounding shareholder capital. It has a cash-rich balance sheet. If we hit a recession, it will have plenty of acquisition opportunities. Over the past two years, Constellation has deployed its highest amount of capital in its history. While it may take time to surface, these actions should translate into very strong cash flow growth.

Given Constellation is a fairly large company today (a market cap of $41 billion), returns could slow over the coming decade. Let’s say its annual rate of return declines to 25%. If you put $20,000 into this stock today, your investment could still be worth $186,260 in 10 years and $568,400 in 15 years.

The bottom line

No historical rate of return is guaranteed in the future. However, strong past returns can indicate that a stock has a “secret sauce” for success. When you find these great businesses, the best thing you can do is buy them in a TFSA or RRSP, hold them, and let them compound your wealth for very long periods of time.