The Tax-Free Savings Account (TFSA) is the ideal place to compound passive income. Any capital you invest has zero tax liability on the income or gains that you earn. As opposed to a non-registered investment account, you get to keep 100% of the dividend income you earn in a TFSA.

The TFSA is the perfect place to compound long-term passive income

If you have no immediate need for the passive income, you can re-invest it back into buying more shares. The more shares you buy, the more dividend income you can earn. Top cash-yielding businesses often raise their dividend rates regularly as well. That is another source for compounding dividend income.

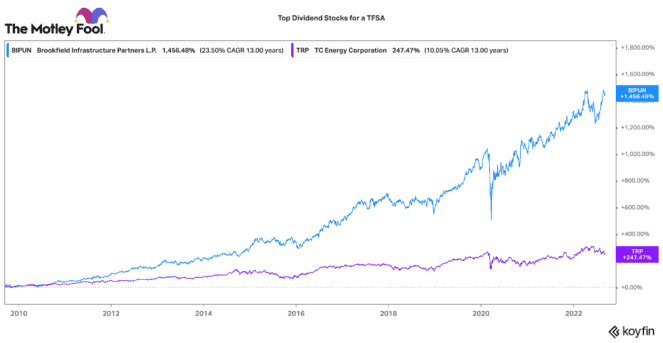

The most exciting concept about owning stocks is that you also get to participate in the capital upside of the business. Not only do you collect dividends, but as a business grows in earnings and value, you also get to enjoy the upside from share price appreciation.

Over decades, a TFSA could become a passive income fund that significantly funds your lifestyle later in life. If you are looking for income and long-term upside, here are two solid Canadian stocks to buy in a TFSA.

TC Energy

The world is going through an energy crisis as we speak. I suspect it will be an issue we are discussing for years and even decades ahead. TC Energy (TSX:TRP)(NYSE:TRP) is a dividend stock that is helping to alleviate some of these problems.

With $100 billion of pipeline, storage, and power assets, it is one of the largest natural gas infrastructure businesses in North America. It is set to be a key player in the transport and export of North American natural gas in the years ahead.

Right now, it is advancing a $29 billion capital plan. Management expects that to drive 5% annual adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) growth for the next five years. That should support its target of 3-5% annual dividend growth.

In the meantime, TRP stock investors can collect a very attractive 5.7% dividend today. For consistent 8-10% annual total returns, this stock is one to hold for some solid upside.

Brookfield Infrastructure Partners

If you want a broader play on global infrastructure, Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is the ideal long-term TFSA stock. It is more diversified than TC Energy. It owns ports, railroads, export terminals, gas-processing facilities, pipelines, power transmission lines, cell towers, and data centres.

These are all essential assets to the functioning of our modern society. Consequently, revenues are highly contracted, and cash flows are well hedged against inflation. Despite economic worries, this well-diversified business tends to perform well in most economic environments.

In its most recent quarter, the company grew organically by over 10%. Funds from operation per unit increased 20%. Likewise, it just announced a huge initiative to partner with Intel to onshore semiconductor manufacturing in the United States. This just shows that BIP is not slowing down, even though the economy might be.

Today, this TFSA stock earns a 3.3% dividend yield. It raised its dividend 6% earlier this year. BIP stock pays an attractive, growing dividend, it has defensive characteristics, and it is growing faster than most utility peers. It is the ideal long-term stock to hold in a TFSA for massive long-term upside.