Value and income. Canadian investors continue to look for both across the board when it comes to TSX stocks. While growth is inevitable with the TSX today down by about 10% from peak-to-current performance, value and income are far less stable.

But not with these three TSX stocks. Here you can lock in passive income for your Tax Free Savings Account (TFSA) that will last years. So let’s get right to it.

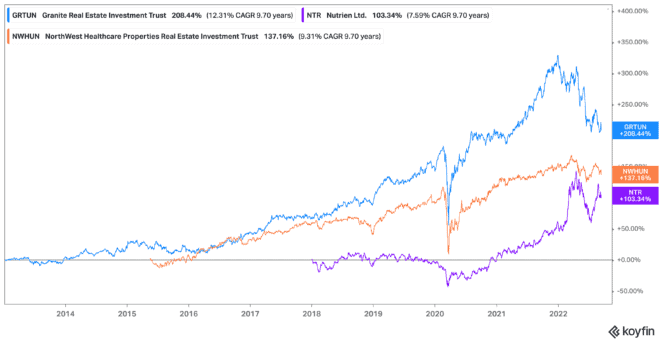

Granite REIT

Granite REIT (TSX:GRT.UN) offers value no matter how you look at it. Granite stock currently trades at 4.4 times earnings, with a total debt-to-equity ratio of 0.48. Further, you can lock in a dividend yield of 4.02% while shares trade down by 28% among TSX stocks.

This is a huge deal on Granite stock, after the company saw shares drop after e-commerce companies slouched. Granite stock has grown through the acquisition and creation of industrial properties. And if you recall, we need these properties more than ever. That’s due in part to the recent supply-chain issues we’re experiencing.

So if you have a TFSA and want passive income, I’d seriously consider this undervalued stock that’s grown 210% in the last decade alone.

Nutrien

Nutrien (TSX:NTR)(NYSE:NTR) is another of the best passive income TSX stocks for your TFSA. Nutrien stock exploded this year when sanctions were placed against Russia. The country produces cheap crop nutrients and potash, but supplies have dwindled. Enter Nutrien stock to fill the void.

Though with the market correction, Nutrien stock fell as well. Yet that doesn’t mean it should have dropped. For investors seeking value and passive income for their TFSA, the company is well-positioned for growth. It trades at just 7.5 times earnings, offering a dividend yield of 2.05%. Plus, it’s a growth stock among TSX stocks, up 28% year to date!

While Nutrien stock hasn’t been around as long, it’s certain to keep climbing. The agricultural industry will continue to demand crop nutrients as less arable land becomes available. As Nutrien feeds this demand, the stock has more than doubled since coming on the market.

NorthWest REIT

Finally, NorthWest Healthcare Properties REIT (TSX:NWH.UN) is a highly sought after passive income investment among TSX stocks. Since analysts expect that the world will continue to need healthcare properties, investors see value. And rightly so, given it trades at 7 times earnings.

Healthcare remains an essential service that will simply never go away. NorthWest stock has seized this opportunity and continues to grow its diverse set of properties on a global scale. And with an average lease agreement at 14.1 years, it’s created a stable foundation for those seeking passive income.

Right now, that passive income comes with a dividend of 6.28%. While the dividend hasn’t grown, that’s due to the company’s growth through expansion. So give it time, and you’re sure to continue seeing dividends remain this high. Meanwhile, shares are still up by 137% since coming on the market in 2010.

Foolish takeaway

All three of these TSX stocks offer secure passive income. They are well-positioned for growth in strong industries that simply won’t be going away any time soon. Now is the time to lock them in while they trade within value territory, with each offering a price-to-earnings ratios below 10.