I’m going to make things really simple for those reading this article today. Instead of giving you potential scenarios, I’m going to use my own scenario to give you insight into what TSX stocks you should hold into retirement.

My hope is that I can show you that by investing $1,000, you can see how much growth you can reach by the time you retire. I’m currently in my 30s. So, if you’re 30, then retirement may not be until you’re 65. That’s 35 years of growth to look forward to.

In this case, $1,000 can certainly get you far. But these are the TSX stocks to get you the farthest.

CIBC stock

One of the best buys I’ve made in the last few years is Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM). CIBC stock is a Big Six bank, providing me with the largest dividend yield of the batch. Plus, it’s super cheap in more ways than one.

CIBC stock currently trades at just 9.22 times earnings. It has a dividend yield that’s at 5.23%, and another benefit is the recent stock split that puts it at the low end among the other Big Six banks.

What’s more, that dividend has been rising again and again in recent years. In the last decade alone, CIBC stock boasted a compound annual growth rate (CAGR) of 6.31% to look forward to. And that’s been even higher in recent years. It’s one I’ll continue to buy and where I’d put $1,000 right now.

Brookfield Renewable stock

Another of the TSX stocks I’ve been happy to own is Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP). I love Brookfield stock for a number of reasons right now. First off, it’s been performing well in this year alone. But long term, shares are growing higher and higher, and I expect more of that during this transition to clean energy.

But what I love about Brookfield stock right now is the dividend. It currently provides me with a 3.42% dividend yield that’s grown at a CAGR of 8.84% during the last decade. And I expect more growth like this, as people around the world buy renewable energy-producing companies like this one.

Invest that $1,000

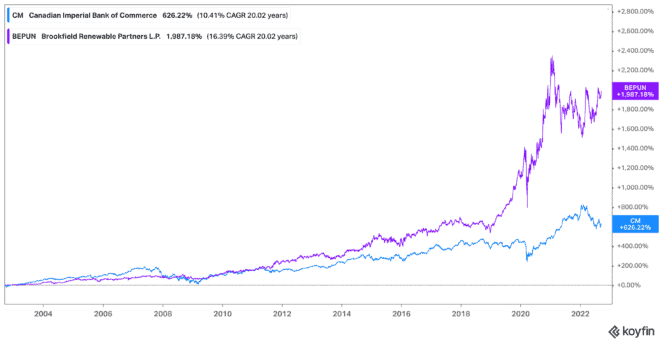

Let’s say you’re that 30-year-old who has $1,000 to put towards both of these TSX stocks. We’re going to consider the CAGRs for both the dividend and also the stock price itself. In the case of CIBC stock and Brookfield stock, these come to 10.4% and 16.4%, respectively, over the last two decades.

So, if you were to buy $1,000 in each, you could potentially see these TSX stocks grow by that amount during the next 35 years as well. Also, you could take your dividends and reinvest them back into your share price.

In this case, the $1,000 investment in each of these TSX stocks could come to $77,963 in your portfolio and about $1,093 in dividends each year for CIBC stock. For Brookfield stock, you could have a portfolio worth $290,647 and annual dividends of $924. That’s a combined total of $368,610 from a $2,000 investment.