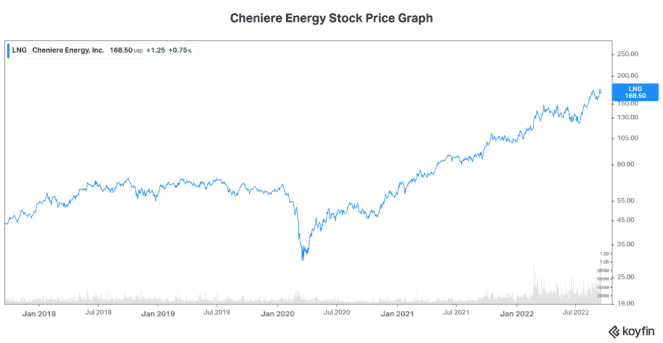

Cheniere Energy (NYSE:LNG) is the leading U.S. producer and exporter of liquified natural gas (LNG). In fact, 11% of global LNG is produced by Cheniere. Soaring global demand has elevated it to the $42 billion powerhouse that it is today. But what makes Cheniere Energy stock a millionaire-maker stock?

Global demand soars, as the world clues into North America’s greatest resource

It’s an undisputed fact that North American natural gas is the world’s cheapest, cleanest, and most reliable energy source. It’s also an undisputed fact that these qualities have never been as much in demand as they are today.

First, let’s look at the fact that North American natural gas is the cheapest in the world — a great thing, especially in today’s inflationary environment. It’s the cheapest because technological advancements have made it so. New ways of extracting natural gas, such as fracking, have increased production. This has driven economies of scale and, ultimately, cheaper production costs.

In addition, North American natural gas is the cleanest. Strict environmental guidelines have mandated a lower carbon footprint for the fossil fuels industry. Furthermore, natural gas is replacing coal in many countries around the world. Natural gas is comparatively much cleaner relative to coal.

Lastly, North America has stable political and economic systems. One cannot escape the fact that this is not necessarily so around the world. So, it’s logical that Cheniere has a whole host of current and potential customers looking for a reliable source of energy. More on this a little later.

Cheniere benefits from this strong secular move toward North American LNG, making it a stock to buy today

In its latest quarter, Cheniere posted very strong results once again. Revenues were $8 billion, 165% higher versus last year. Also, adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) was $2.5 billion, up almost 150%. Lastly, distributable cash flow was $1.9 billion.

Cheniere has been using its cash flow primarily to shore up its balance sheet. In fact, the company has lowered its debt balance by about $5 billion in the last few years. In turn, Cheniere is on the cusp of achieving “investment-grade” status. This provides many benefits, such as lowering the interest rate at which the company can borrow money in the future.

Cheniere is now moving rapidly to other uses for its cash. For example, its annual dividend will be increased 20% to $1.58 per share. Also, its share-repurchase authorization was increased by $4 billion.

Infrastructure expansion will give LNG industry (and Cheniere) a significant boost

Corpus Christi is Cheniere’s liquefaction facility that’s located in Texas. It’s been in service since 2019. It currently has three liquefaction units, which were all completed on schedule and within budget. Today, with global demand soaring, Cheniere is in a race to expand.

Stage three at Corpus Christi recently got the green light. It’ll consist of seven liquefaction units. Each will add approximately 10 million tonnes per year (mpta) of production capacity. This will take the facility to 25 mpta of production capacity. Beyond this, Cheniere also sees an easy and clear path to get to 30 mpta. Management is confident they can achieve this through stage-three expansion and debottlenecking. With this, Cheniere will be more ready than ever to meet the surging demand from Asia and Europe.

So, with more long-term contracts being signed, Cheniere is becoming a stock to bet on. For example, since the start of the second quarter, contracts for more than 140 million tonnes have been signed. These contracts go out to 2050. In addition, many contracts that have been entered this year go out to 2040. Finally, a contract with Petrochina was recently signed. This contract goes out to beyond 2050. In short, this increased visibility and strong demand forces should push Cheniere Energy stock much higher.

Motley Fool: The bottom line

In closing, I would like to reiterate my belief that Cheniere Energy the stock to buy today. It is, in fact, a millionaire-maker stock. The energy transition is in full swing, and natural gas is a beneficiary. LNG is finally having its day, as it meets the soaring global demand for North American natural gas.