Investors looking at Canadian stocks have been very interested in dividends recently. It’s clear why, as the TSX today continues to be far down from 2022 highs. Still, if you’re looking at these Canadian stocks for dividends, you want to be careful. Not only do you want to find a high dividend yield, but you want to make sure that dividend is stable and not set to be cut.

That’s why today, I’m going to look at two Canadian stocks with yields above 3%. Both of them are solid buys if you’re looking to hold long term. However, I would consider one of these stocks to be better if you’re looking for short-term gains as well as a stable dividend that’s not going to be cut anytime soon.

BCE stock

First, let’s look at BCE (TSX:BCE)(NYSE:BCE). BCE stock is the largest of the telecommunications companies in Canada. It currently holds the largest market share with a market cap of about $56.7 billion. What’s more, it’s continuously growing its business.

During the last few years, especially with the pandemic and Canadians working from home, it’s one of the Canadian stocks that seriously benefited. It’s fibre-to-the-home network has expanded throughout the country, and the 5G rollout through its wireless network has brought more Canadians than ever to BCE stock. Add this on to its media presence, and BCE stock is a strong option for those seeking long-term income.

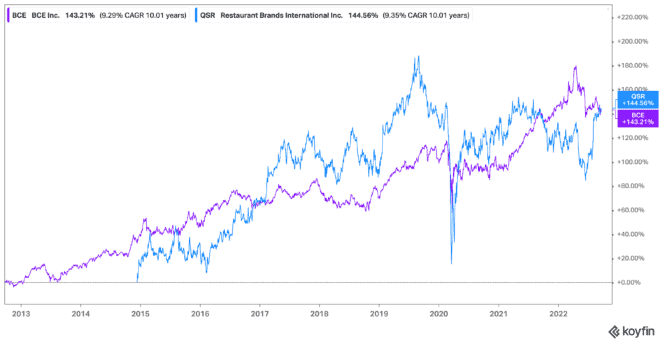

Among Canadian stocks, it has one of the longest histories of share growth and dividend growth. Shares are up 485% during the past two decades for a compound annual growth rate (CAGR) of 9.23%. Meanwhile, its dividend sits at 5.91% and has grown by a CAGR of 5.76% during the last 20 years.

Yet shares are currently down by 1.4% year to date, offering a great time to jump in on the stock — especially as other Canadian stocks remain far below these levels.

Restaurant Brands stock

Another consideration for investors is Restaurant Brands International (TSX:QSR)(NYSE:QSR). Among Canadian stocks, it continues to rise with pandemic restrictions dropping back. While in-store sales were down, the company focused on upgrading its mobile and take-out services. Also, the partnership with Justin Bieber for Tim Hortons has proved incredibly fruitful. This has led to an intense increase in revenue from the brand. However, Restaurant Brands’s other fast-food chains have not had as much in increases as Tim Hortons.

Honestly, it’s a little unclear how Restaurant Brands stock will fare in the short term. With inflation and interest rates rising, Canadians are likely less to spend their hard-earned money on takeout that continues to rise in price. In the long term, I’m sure that Restaurant Brands stock will make a recovery, but during this downturn, it simply isn’t as strong as a BCE stock.

Furthermore, Restaurant Brands stock doesn’t have the history that BCE stock has. It’s only been around for about a decade, so growth has only been about 145% during that time. That comes to a CAGR of just 4.57% in that short time.

Meanwhile, it offers a dividend yield of 3.56%, and that’s something. But if store performance continues this way, it may be forced to cut it back or, at the very least, stop increasing it. Right now, its CAGR sits at 28.3% — something I’m not sure will continue.

Even still, shares of Restaurant Brands stock are up this year by 5.87% during this rebound from the pandemic. If you’re looking for some short-term defence, it may provide that.

Bottom line

Both of these Canadian stocks are strong dividend stocks to consider. However, if you’re looking for a company that will continue to do well in the decades to come, I would consider BCE stock over Restaurant Brands stock.

Restaurant Brands is still relatively new, and I’m not sure can continue to keep its dividend rising at the rates we’ve seen over the past few years. Meanwhile, BCE stock is a Dividend Aristocrat continuing to raise its dividend at a stable rate. Plus, it has a stable future as the leading telecommunications company in Canada. And with a dividend that’s higher than Restaurant Brands’s, it really doesn’t seem to be much of a choice between the two.