Growth stocks may not exactly be on everyone’s mind right now. And I get that. Growth stocks have been bad for your portfolio in the last year or so. After some huge growth in over a decade, shares are now correcting. In some places it’s warranted. But in others? Not so much.

Today, I’m going to discuss why investors should consider buying these growth stocks right now before it’s too late.

WELL Health

I don’t think investors realize the opportunity being missed by not investing in WELL Health Technologies (TSX:WELL). WELL Health stock has been growing its business for the past few years, exploding during the pandemic. And it’s clear why. As a telehealth provider, acquiring business after business across North America, it’s one of the growth stocks that seems a sure thing as Canadians were forced to stay home.

But then a vaccine hit, and suddenly Canadians weren’t interested any more. But the question is, “Why?” Telehealth is not just still going on, but still a strong part of the healthcare system. Meanwhile, WELL Health stock has become the largest outpatient clinic in the country!

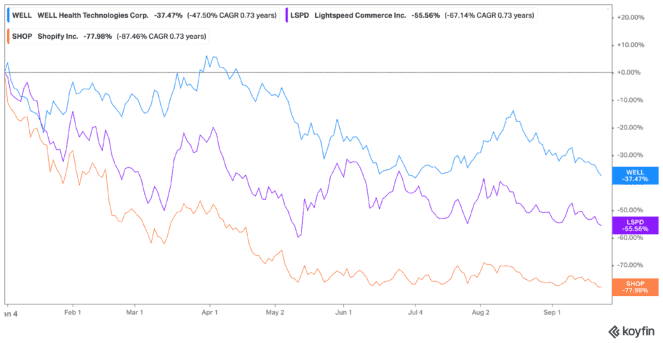

Shares are now down 37% year to date, despite continuing to grow and post record revenue. Furthermore, it offers intense value with the ability to cover all its debts with just 47% of its equity. Even with shares down, it’s still up by about 1,370% in the last five years. So, I would take this as the opportunity you were waiting for to buy up WELL Health stock.

Lightspeed stock

Lightspeed Commerce (TSX:LSPD)(NYSE:LSPD) is different from other tech growth stocks. Lightspeed stock isn’t just dependent on e-commerce to keep its revenue flowing; rather, it depends on its point-of-sale system, which is what’s going strong, as consumers go back to in-store shopping and eating.

Yet again, Lightspeed stock has been marked as a tech stock — one with a volatile history. Granted, the short-seller report against it was bad. But since, then the company has come a long way and now offers revenue sources from its five major acquisitions.

Shares are down 55% year to date and even further since all-time highs. Even still, Lightspeed stock is a steal today, as revenue comes in higher. As the company chips away at its net loss and sees shares rise once more, this could be the time when you look back and ask why you didn’t buy.

Shopify

Shopify (TSX:SHOP)(NYSE:SHOP) is indeed an e-commerce stock. Furthermore, it’s one that’s made a lot of mistakes in the past. This includes growing too much, too quickly, and its chief executive officer admitted to that. But Shopify stock is still going to be a major winner over the next few years.

Despite its volatility, it all comes down to merchant growth. Subscription revenue is certainly growing, and once they’re signed on, they pretty much need to stay. That’s because its’ a one-stop shop for merchants to build their customer base and improve it, get paid, and fulfill orders. And at a time when everyone needs to cut costs, it’s likely more will move over to Shopify stock where it can all be done in one place for one charge.

Yet again, Shopify stock is in the worst scenario with shares down by 78% year to date. That being said, e-commerce is set to boom once more after inflation and interest rates are under control. When that happens, prepare for Shopify stock, and these other growth stocks, to explode upwards.