Undervalued stocks can be one of the best ways to increase your portfolio returns. Especially if those companies are dividend stocks. You can use your dividend income to reinvest in your portfolio, allowing you to triple your portfolio far faster than if you were to just set it and forget it.

And if there are three undervalued stocks I would pick, it’s these.

CIBC

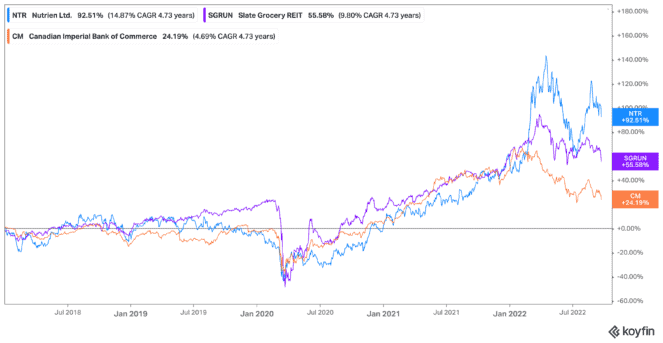

Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM) is the first I would choose for a few reasons. First, it’s one of the undervalued stocks in the banking sector. Canadians sold off their stocks during this market downturn. Fair enough. But CIBC stock and the Big Six Banks have all historically recovered within a year of these downturns.

Now, CIBC stock is one of the undervalued stocks trading at just 8.7 times earnings. It’s also near oversold territory trading at 34 on the relative strength index. All this means, you can lock in its already high dividend yield, which is at 5.34%.

But what makes CIBC stock the best of the Big Six is its share price. After going through a stock split, you can pick up shares for far less than those of the other banks. So CIBC is a good pick of the bunch for investors seeking to have even a small stake on the TSX.

Nutrien

Another of the undervalued stocks I would consider is Nutrien (TSX:NTR)(NYSE:NTR). Nutrien stock went through a volatile period when shares soared, then fell after the Russian invasion of Ukraine. The crop nutrient producer, following sanctions on Russia, is taking on many new clients. But the company was already going strong, acquiring business after business and growing its e-commerce arm in the meantime.

Now, despite still being up by 21% year to date, Nutrien stock is still considered one of the undervalued stocks trading at just 6.9 times earnings on the TSX today. Honestly, analysts believe this stock has a bright future, even though it’s only been on the market for a little while. With such a stable future ahead of it, it’s clear why.

You can now pick up Nutrien stock and lock in another high dividend yield at 2.07% before shares climb higher.

Slate Grocery REIT

Finally, if you’re looking for income-producing undervalued stocks, look at Slate Grocery REIT (TSX:SGR.UN). Slate is stable thanks to its purchase of real estate properties in the grocery sector. These chains offer sustainable income that, as we’ve seen, even produce income during a pandemic.

Yet even though Slate has a stable future and solid income, investors haven’t been keen on the stock. SGR currently trades at just 5.9 times earnings. This gives investors a chance to lock in a whopping 8.03% dividend yield as of writing!

On the TSX today, shares are only down by 3%, compared with so many other REITs that are far lower. So it’s likely that as soon as there’s positive movement, shares will rise beyond that January mark.

Triple your portfolio

If you were to invest $5,000 in each of these undervalued stocks, you could triple your portfolio in a very short period of time. In fact, that initial $15,000 would turn into $57,464 in just a decade!