Dividend stocks remain some of the more popular TSX stocks for investors these days. The TSX is still down 13% year to date, putting it solidly within market correction territory and nearing 52-week lows.

Now is the time to pick up TSX stocks that pay you to own them. But not every stock has a high dividend yield. And what’s more, not all of these dividends will keep rising. So, here are two TSX stocks I would consider with dividends that will keep on growing.

CIBC

Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM) is a solid buy in this cheap environment. As one of the Big Six banks, it’s proven time and again that it can come back to pre-fall prices within a year’s time. But it also means that it provides dividends that have been growing solidly for decades.

CIBC stock, however, has the added bonus of having the highest dividend yield of the Big Six banks at 5.45%. It also has the cheapest share price after its stock split, now at $61.50 per share. What’s more, it’s in value territory trading at just 8.8 times earnings.

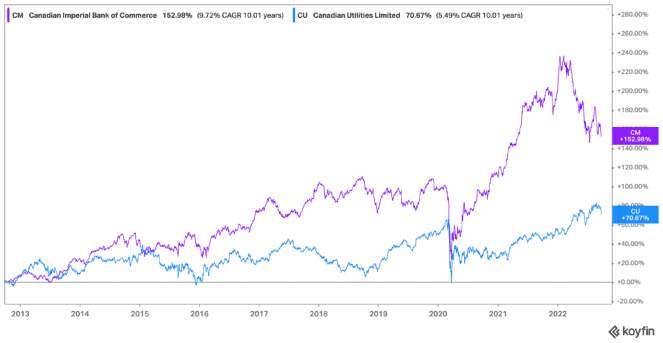

Furthermore, CIBC stock has been making changes to increase its customer services. This has brought in more and more clients at a time when many aren’t taking out loans. Finally, it’s shown over and over that it will increase its dividend. In the last decade, it’s increased its dividend by a compound annual growth rate (CAGR) of 6.31% — all while shares have grown at a CAGR of 9.72% during that time.

Canadian Utilities

Now, if you want a stock that will keep growing its dividend, go with the only Dividend King on the TSX today. Canadian Utilities (TSX:CU) currently holds that place of honour, providing investors with sustainable, stable revenue and dividend payments.

Now Canadian Utilities stock isn’t in value territory, but there’s a reason for it. Utility stocks have seen more attention given their stable revenue options. Canadian Utilities stock is no exception, growing its revenue year after year, as it provides utilities to customers no matter what the market does.

Even still, it does provide a reasonable 18.69 times earnings to investors. All while offering a 4.5% dividend yield. One that’s grown at a CAGR of 7.2% over the last decade. In that time, shares have grown at a CAGR of 5.54%. That’s not exorbitantly high but definitely stable.

Foolish takeaway

It’s all well and good to find TSX stocks that offer high dividends. However, if you’re going to do this you need to make sure those companies will continue to pay those dividends. In the case of Canadian Utilities stock and CIBC stock, you can be all but assured you’ll continue seeing shares and dividends rise for decades.

However, if I’m choosing just one of these stocks today, I’m going with CIBC stock. As mentioned, shares have recovered to pre-fall prices within a year of any market downturn. Now in correction territory, you could see a crazy recovery in the next year and beyond. All while locking in the highest dividend yield we’ve seen in some time.