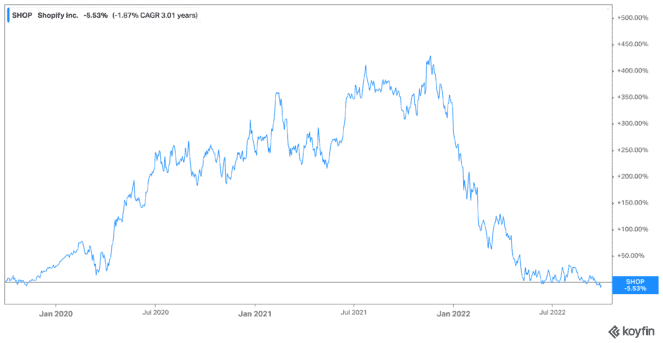

Shares of Shopify (TSX:SHOP)(NYSE:SHOP) hit 52-week lows this week, nearing the lowest price it’s seen since before the COVID pandemic. Of course, one does have to take into consideration the stock split, but even so. Shopify stock has dropped further and further in this poor market environment.

But when investors get fearful, that’s when others get greedy. So is now the time to get greedy over Shopify stock?

The bear case

It was beyond belief that shares would fall as far as they have, but there could certainly be more drops to come for Shopify stock. The e-commerce company has fallen victim to many other tech company problems. It expanded too much, too soon, and had massive layoffs underway to make back some of that cash.

Shares reached all-time highs back in November 2021. Almost a year later, they have been falling like a stone ever since. It certainly doesn’t help that executives are being replaced, and employees are now offered payment options that may no longer include shares.

Merchant numbers have fallen by 2% quarter over quarter, as growth in e-commerce spending remains sluggish. There is simply so much uncertainty surrounding Shopify stock and its future. And that’s leaving investors simply uninterested in getting in on this mess.

The bull case

That being said, analysts do believe that there are signs Shopify stock will rise from the ashes after a potential recession hits. Its Shopify Plus, payments and point-of-sale systems in particular, has shown “continued momentum,” one analyst stated. Further, monthly recurring revenue continues to rise, partially through higher prices.

While there is still that uncertainty, analysts believe the tech company will rebound and fast once consumers are back online shopping. In fact, analysts’ average price target for SHOP is US$72, more than double today’s share price.

What it comes down to is Shopify stock is not for the faint of heart. If you’re willing to buy this stock and hold it for decades, now could be a buying opportunity that you won’t see again. Further, the stock could rebound significantly in the next few years. Perhaps hitting those all-time highs once again.

Bottom line

If you’re an investor looking at Shopify stock as an opportunity to get in on one of the biggest growth stock stories of the last few years, be careful. This certainly isn’t going to be the future of this stock.

Frankly, Shopify stock had a lot of problems it was forced to deal with when consumers stopped spending. And even the chief executive officer admitted that the company made some mistakes. Shopify stock is paying for those mistakes now, and it could be some time before it reaches profitability.

But what this means is Shopify stock is emerging stronger from the downturn. It’s not as if the company is suddenly going to go under. While cuts were made, it looks like Shopify may soon reap the benefits of its efficiency improvements. But remain cautiously optimistic. If the recession does indeed come next year, there could be more news and more share drops on the way.

If you’re looking decades ahead, Shopify stock could be a great buy even at conservative growth levels. You’ll have to be willing to be quite patient while it grows in the years to come. Especially through 2023.