There are a lot of people out there wanting to invest but super nervous about it. And that’s completely warranted right now. The TSX today is at or near 52-week lows as of writing, down 12% year to date and falling. Some of the growth stocks we thought would never come down are now reaching 52-week or even all-time lows. So, where on earth should investors look today?

The answer: Passive income, not growth

The problem is that some investors started out with growth stocks a few years back and have no idea what to look for now. The growth stocks that once served them so well are now falling left, right, and centre. So, where should investors look instead?

The answer: passive-income stocks, but not just any passive-income stock, of course. Investors should consider stocks that will continue to see passive income build over the years, not fall. Furthermore, consider stocks that offer security both in terms of how long they have been around and in terms of their industry.

Buy a bank

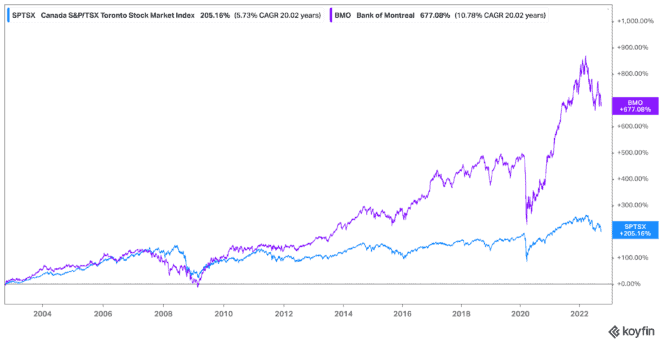

That’s why I like the Big Six banks. These banks have been around for over 100 years and, in some cases, 200 years. Shares have grown higher and higher, but they do fall during a recession or market downturn. That’s been the case right now as well. But as you can see looking back, the banks have recovered to pre-fall prices within about a year’s time of the downturn.

That’s the case for Bank of Montreal (TSX:BMO)(NYSE:BMO) stock, which has seen shares fall, but not as dramatically as the other banks. In fact, while the TSX is down 12%, BMO stock is down just 8.5% year to date.

Further, it’s been growing its profile, now expanding further into the United States with the acquisition of Bank of the West. And it’s the most valuable of the banks, trading at just 7.24 times earnings! Of course, you can also lock in one of the highest dividend yields at 4.58%.

But I don’t have the money!

Inflation is up, interest rates are up, and, therefore, your cash is down. If you’re looking to create $500 in passive income, it means you would need to invest a whopping $10,791 as of writing. That’s not a small amount considering costs are rising but your paycheque isn’t.

The answer? Rent out anything you can. Ideally, I would stick to property that you have rather than items that could end up stolen. In Toronto, for example, you could rent out your downtown parking spot for $350 per month. That’s $4,200 annually right there.

You could also rent out a garage, a storage unit in your apartment building, a shed — heck, rent out your attic! And right now, people are dying to find cheaper storage for their small businesses, so it’s time to think about expanding you passive income as well.

Foolish takeaway

This could all help you create that $10,791 it would take to invest in BMO stock today. By the end of the year, you’ll have that money back as well as an additional $500 in passive income! Never mind the share growth from BMO stock. And that could be significant, especially considering it would be a 30% increase to reach 52-week highs. And if you throw that in your Tax-Free Savings Account, you can collect all this cash tax free!