It’s always exciting to invest in a growing industry. Right now, that industry has to be renewable energy stocks. These stocks have a great future ahead of them, and investors could certainly generate massive value by investing today.

The problem is, we’re currently going through an economic downturn. The TSX is down 12.5% year to date as of writing. After a slight recovery, shares are back down yet again thanks to recent incoming earnings reports.

So that’s why today I’ll be looking at renewable energy stocks where investors can safely put their cash. What’s more, investors can also lock in passive income for life.

Look for a history

What investors should first consider when looking at renewable energy stocks is finding stocks that have been around a long time. I don’t mean just a few years, but decades. These are likely to include blue-chip companies that have already gone through most of the initial growth phase. This includes major acquisitions, building, and other growth initiatives that typically involve a lot of spending.

With that spending done, it’s more about growing slowly and collecting revenue. That revenue can therefore be distributed as dividends to investors. And many renewable energy stocks do have this cash flow.

Renewable energy isn’t new, after all. In fact, it’s quite old, with some companies putting their money here well before the oil and gas boom of the 20th century. And if I were going to invest in only one of those companies, it would be Brookfield Renewable Partners LP (TSX:BEP.UN)(NYSE:BEP).

Brookfield Renewable stock

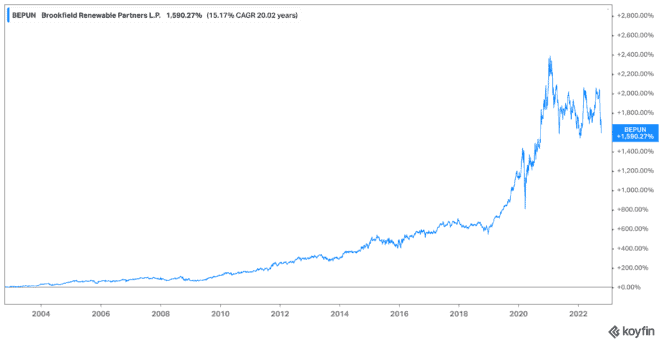

Brookfield Renewable stock looks old enough on the surface. It’s been trading on the market just about two decades, which is definitely a substantial track record. However, if you look at the parent company Brookfield Asset Manager, it becomes more impressive.

The parent company has been investing in renewable energy for well over a century, edging on 150 years! It started this growth in Guatemala, and has been growing this arm ever since. Now, it has one of the best renewable energy stocks on the market.

Why? Because it doesn’t attach itself to one kind of asset. Brookfield invests in practically every kind of renewable energy on the planet, all over the planet. It’s this diversified revenue that allows investors to remain confident about the company’s growth, and its dividend.

How much are we talking here?

Brookfield currently offers a substantial dividend yield at 4.10%. This dividend is far higher than earlier this year, as it’s one of the renewable energy stocks down 8.8% year to date. However, you’ll notice this is still an improvement compared with the performance of the TSX today.

In other words, this could mean the deal on this renewable energy stock won’t last long. Investors should therefore seize the opportunity and latch onto that 4.10% dividend yield for the steal it is. A $5,000 investment could bring in $217.50 on the TSX today. That same investment would have brought in just $164 at 52-week highs!

Bottom line

If you’re looking for passive income from renewable energy stocks, I would highly consider Brookfield stock. It has strong growth behind it, up 1,591% in the last two decades, and a high 4.10% dividend yield to look forward to. But these deals won’t last forever, so get it before it’s gone!