Cenovus Energy (TSX:CVE)(NYSE:CVE) has had quite the run over the last few years. While other oil and gas companies were floundering, Cenovus stock was doing just about the exact opposite. The company was growing, acquiring Husky Energy to turn into the third-largest energy company in Canada.

However, before you think that size is power and buy Cenovus stock, here are five things to know about the company.

1. Hitting targets

One of the top points that Canadian investors will like about Cenovus stock is it was hitting its targets. Cenovus stock aimed to create $1 billion in synergies through its Husky acquisition in the first year. It surpassed that within the first year, and has continued climbing ever since.

The integrated oil company, which focuses on Canadian oil sands, now has targets of growing further. This includes buying up the remaining 50% stake in its Toledo Refinery for US$300 million. Shares reacted to the news and jumped 20% in the next month.

2. Solvent-aided process

Another note by economists is that Cenovus stock has its solvent-aided process to look forward to. This process allows them to refine oil on site. No shipping it off, but instead skipping a time-consuming process that could save millions through time and cost savings.

Economists believe this process will create substantial long-term growth for the company. However, it’s still a few years from being fully integrated. Even still, today’s investor should look forward to it in the years to come.

3. Current earnings are strong

I say current for a reason. Over the last few years the oil market has been performing poorly. But with Russian sanctions and pandemic restrictions relaxing, oil is in demand once more. So it’s a great time for investors to consider the stock in this wake.

Cenovus stock generated $3 billion in cash from operating activities in its last quarter, reducing long-term debt to $11.2 billion. It also increased its capital investments guidance for the year by $400 million to between $3.3 and $3.7 billion.

4. Change is coming

The problem with Cenovus stock is that despite doing so well, change is inevitable. Even with all this growth, there is the issue that the world is shifting to renewable energy. This is certainly something investors need to consider, especially if they want to invest today.

While Cenovus stock is planning on adding its solvent-aided process across the board, it won’t be any good if we no longer need oil like we used to. This raises the issue of whether it’s money well spent investing in an industry that could be dying.

5. In the end, it’s cheap

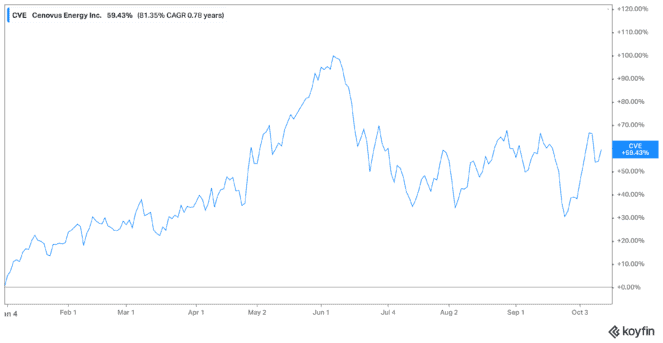

Yet, if you believe Cenovus stock will at the very least see some recovery in this poor market and keep climbing, by all means invest. It trades at 11.9 times earnings, while offering a 1.78% dividend yield right now. Shares are up 59% year to date, but down 20% from highs seen in June.

With that in mind, it looks like a good time to jump in on the stock. But if you choose this option, I would consider adding some alerts for when it reaches your share price target. Because I doubt it will be a stock that remains around in the next few decades.