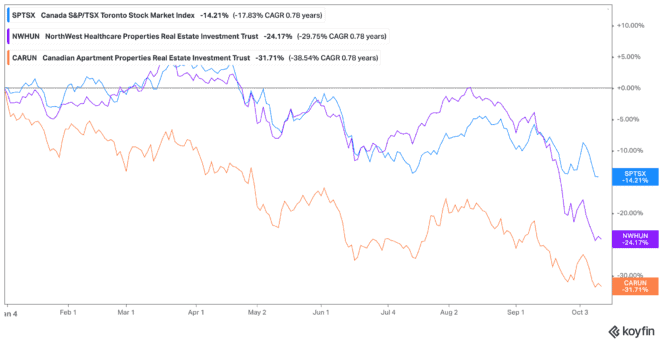

Just when we thought it couldn’t get any worse, the TSX dropped dramatically this week, hitting 52-week lows on the back of United States inflation data.

Yet while it may seem that all is lost, and we say it again and again, now is the time investors should be buying up strong stocks — especially dividend stocks that could double your money in the next three years!

Through a combination of reinvesting those dividends and choosing strong dividend stocks that are down on their luck, investors can buy and hold and see their cash soar.

NorthWest REIT

One of the top choices I would consider right now is NorthWest Healthcare Properties REIT (TSX:NWH.UN). There are a few reasons, but first and foremost, it’s a dividend stock with an ultra-high yield at 8.03% as of writing!

That yield usually sits around 6%, showing just how far the stock has dropped. Shares are down about 20% year to date but not due to anything done by the healthcare real estate investment trust (REIT). In fact, during the pandemic, the company made so much money that it was able to expand. So, while it’s relatively new, it’s created acquisitions for long-term, stable income.

With shares down so low, I would certainly consider picking this up with your other dividend stocks. Shares currently sit at $10 per share, providing you with a potential upside of 44.2% to reach 52-week highs. Meanwhile, it should safely rise, considering it trades at 5.71 times earnings, with just 88.37% of equity needed to pay down all its debts.

Canadian Apartment REIT

Another strong company I’d recommend for secure cash is Canadian Apartment Properties REIT (TSX:CAR.UN). With home prices so high, many Canadians have resigned themselves to renting rather than owning, and that means renting apartments in many cases.

CAPREIT has created a solid base of suites both in Canada and in Europe. And while other residential REITs are struggling, this stock remains strong — so strong, in fact, that it would take just 69% of its equity to cover all of its debts. Yet it trades at a valuable 11.04 times earnings!

As the company continues to acquire more properties, and the world continues to shift to apartments and renting, CAPREIT is in a strong position. Shares are down 30% year to date at $40 per share. Right now, it offers a potential upside of 56% to reach 52-week highs.

Double your money

If you’re going to double your money from these dividend stocks right now, it’s important to take into consideration the economic downturn. Within a year from now, it’s quite likely these stocks will be back at pre-drop highs. If that’s the case, a $5,000 investment in NorthWest and CAPREIT could turn into $7,210 and $7,800, respectively!

From there, we’ll look at each of the compound annual growth rates (CAGR) to predict the future growth and reinvest dividends. In this case, that’s a five-year CAGR of 5% and 6% for NorthWest and CAPREIT, respectively. By reinvesting dividends, investors would have $10,619 from NorthWest and $10,664 from CAPREIT! And that’s without any rise in dividends. And that’s all by investing in safe, stable stocks.