Warren Buffett has quietly been betting big on U.S. energy stocks in 2022.

Over the summer, oil prices fell from US$120 per barrel to around US$78 per barrel. Occidental Petroleum (NYSE:OXY) stock fell 21% over the summer. In late August, Berkshire Hathaway (NYSE:BRK.B), Warren Buffett’s sprawling conglomerate, swiped up 5.99 million Occidental shares for around $58 per share. That valued its investment at around $352 million.

Warren Buffett has been loading up on top U.S. energy stocks

Today, Berkshire sits with a 20.9% stake in Occidental. It has regulatory permission to acquire as much as 50% of Occidental’s common stock, if it wishes. This is on top of recent multi-billion-dollar investments in Chevron. Berkshire has also made several large-scale private investments in energy infrastructure and pipelines.

With Chevron and Occidental trading with respective price-to-free cash flow ratios below eight and five times, Warren Buffett clearly sees value in the energy space. He has generally taken a pragmatic value approach to the sector.

Oil demand isn’t going anywhere fast

Earlier this year, Warren Buffett stated, “It wasn’t that long ago, that the idea that anybody produced a barrel of oil was, somehow, something terrible. I mean, just try doing without 11 million barrels a day and see what happens tomorrow.”

Well, that is exactly what is happening in parts of Europe given the Ukraine war and lack of safe global energy supply. While a green energy future is necessary, fossil fuels will be required for years to come. You can’t just turn off the ingrained demand for oil and natural gas.

Consequently, these investments could pay off big for Warren Buffett and Berkshire shareholders. If you are looking to follow Warren Buffett’s lead, there are plenty of cheap, quality energy stocks in Canada today. In fact, given depressed valuations, many Canadian energy stocks could have even more upside than their American peers.

Suncor: A past Warren Buffett energy pick

One interesting energy stock is Suncor Energy (TSX:SU). Warren Buffett used to own Suncor stock from 2013 to 2021. However, Berkshire quickly exited after Suncor halted its dividend and faced several operational/safety issues in 2020/2021.

Fortunately, there are reasons to believe Suncor might be in a turnaround. Firstly, with oil over US$80 per barrel, both its production and refining operations are booming. The company generated record free cash flows last quarter. Excess cash has been deployed towards fast debt reduction and ample share buybacks.

Secondly, Suncor has an activist investor involved. It is looking to simplify its business model, clean up operations, and sell off assets that the market might be mispricing. Suncor just sold off its renewable power portfolio, and there are rumours its retail gas station portfolio could fetch a premium if sold.

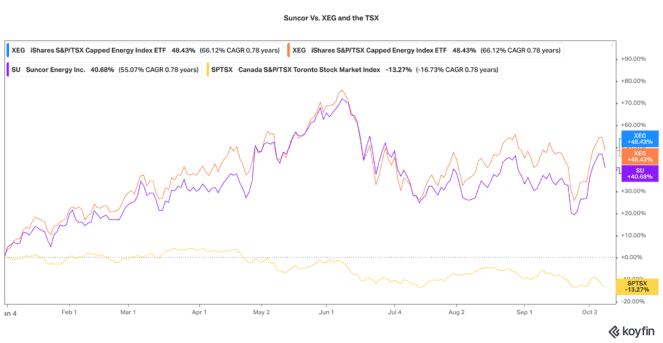

Lastly, Suncor has underperformed its energy peers in 2022. If it executes its turnaround strategy, it could have higher upside. Suncor stock only trades for 4.3 times free cash flow and 4.9 times earnings. That is several multiples below many of its large-cap Canadian peers.

It also earns an attractive 4.2% dividend yield. Its dividend rate should rise once it hits debt targets late this year. For a combination of income and value, Suncor could still hold considerable upside for shareholders.

The bottom line

While Suncor is only one example, there are plenty of small- and large-cap Canadian energy stocks that could prove attractive investments for the next few years. If you want to mimic Warren Buffett, you might want to consider adding these stocks on any weakness or declines.