Like it or not, the best stocks to buy aren’t always that obvious. It’s easy to get distracted by the fundamentals and swept up into the emotions of the market. Today, the TSX might feel like a dangerous place to many of us. But in my opinion, there are still some TSX stocks that represent good buys today. Here are two TSX dividend stocks that could double your money.

Aecon: An undervalued stock to benefit from unprecedented demand

There’s no question that Aecon Group (TSX:ARE) has had a rough ride. The stock is trading at lows, and problems with four of its projects are ongoing. But what does the future look like? On this topic, I think there’s a lot of good news.

Aecon is one of Canada’s largest publicly traded construction and infrastructure development companies. Its revenue comes from infrastructure projects in a wide variety of areas, such as utilities, roads and highways, and nuclear power. In Aecon’s latest quarter, strong demand drove a 16% increase in revenue and a 4% increase in backlog.

The bottom line with Aecon is quite simple in my view: North America’s infrastructure is aging. It simply needs to be upgraded and/or replaced. Also, new industries, such as renewable energy, are creating demand for new infrastructure. This demand is obvious in Aecon’s rising backlog and pipeline of opportunities.

As for Aecon stock, the chart looks bad. Cost overruns, soaring inflation, and supply chain issues have really left their mark. Today, however, Aecon stock trades at a mere 13 times next year’s expected earnings, which are expected to almost double. This makes it a top TSX dividend stock that could easily double your money soon!

Peyto stock: A natural gas leader with a rising dividend

As one of Canada’s lowest-cost natural gas producers, Peyto Exploration & Development (TSX:PEY) is booming. The key differentiating factor with Peyto is that it operates in a very prolific resource basin. Predictable production profiles, low-risk drilling, and a long reserve life all come with this basin. This translates into steady production, low costs, and exceptional efficiencies.

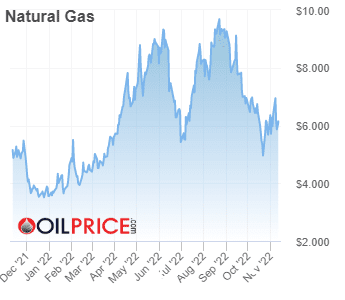

In Peyto’s latest quarter, we can see the effects of this firsthand. Coupled with soaring natural gas prices, Peyto’s resource basin helped give rise to stellar operational and financial results. For example, revenue rose 70% to $280 million. Also, funds from operations rose 89% to $197 million, and Peyto’s operating margin came in at a very impressive 30%. Finally, with Peyto’s balance sheet quickly becoming delivered, Peyto increased its annual dividend by 120%. This TSX dividend stock has it all: growth and a rapidly rising dividend yield of 4.3%. The new 2023 dividend of $1.32 per share represents a dividend yield of 9.5% (on Peyto stock’s current price).

Looking ahead, natural gas fundamentals are expected to stay strong, as the demand/supply outlook is very positive. Simply put, strong and consistent demand, combined with relatively low supply, equals strong natural gas prices. Further into the horizon, Canada’s natural gas market is opening up to global forces, as exports of liquified natural gas are increasing. This will provide an additional demand boost for Canada’s, and Peyto’s, natural gas.

With these very attractive industry fundamentals, and Peyto’s real competitive advantages, it’s not difficult to see how Peyto stock could easily double in fewer than three years.