Look, I get it: nobody actually likes working. After all, imagine what you could do if you had a reliable source of passive income enough to cover your daily living expense plus more. Wouldn’t that be a dream?

Unfortunately, for many of us, it will only be a dream. While generating passive income is hard, generating enough to completely ditch your nine-to-five requires a lot more capital and time than most imagine.

If rental properties aren’t possible, there’s always the prospect of dividend income, right? A big enough portfolio in a Tax-Free Savings Account (TFSA) coupled with the right investments could work, right?

Well, let’s put that assumption to the test. Here’s an honest assessment of how much you would need to invest and what you would need to invest in to quit your job and live off dividend income.

Basic assumptions

Obviously, your living expenses are going to differ depending on a few circumstances. To make this easy and as optimistic as possible, we’re going to assume the following:

- You live in a province with a low cost of living such as Newfoundland and Labrador.

- You’re in good health and require no out-of-pocket procedures.

- You have no dependents that need your support.

According to LivingCost.org. the total with rent for one person, including food, transport, and utilities is roughly $1,407. Let’s round that up to $1,500 to account for pesky things like inflation and miscellaneous expenses like an occasional night out. That works out to $18,000 annually.

Generating this level of income

We’re also going to assume that you have a maxed-out TFSA of $88,000 sitting in cash. To pay out $18,000 per year, you’ll need an investment that generates a 20% yield. Obviously, that’s not sustainable.

The highest-yielding exchange-traded funds, or ETFs, on the Canadian market right now are covered call ETFs. These ETFs use options to generate income but tend to have flat overall returns. An example is the BMO Covered Call Canadian Banks ETF (TSX:ZWB), which yields 7.89%.

A 7.89% annual yield on a $88,000 TFSA works out to around $6,943 annually, or $578 monthly. It’s not chump change, but it’s certainly not enough to live on.

With a 7.89% annual yield, an investor looking to target $18,000 in annual income, or $1,500 in monthly income, will need a portfolio size of around $240,000.

What investors should focus on instead

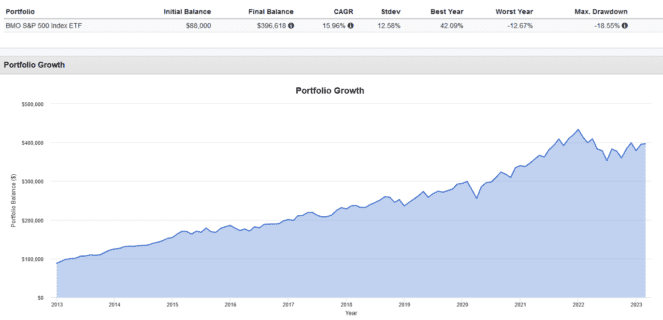

If you have a stable job and earnings, consider investing your money for growth instead. A maxed out TFSA of $88,000 deployed into a low-cost S&P 500 ETF like BMO S&P 500 Index ETF (TSX:ZSP) would have historically produced this result:

Keep in mind, however, that this growth is historical and may not occur again moving forward. Nonetheless, the principles remain the same: make consistent contributions, reinvest dividends, and hold for the long term.

Investing is about delaying gratification. Consider optimizing for growth first and then switching to income once you hit your goals. Consider following the Foolish investing philosophy!