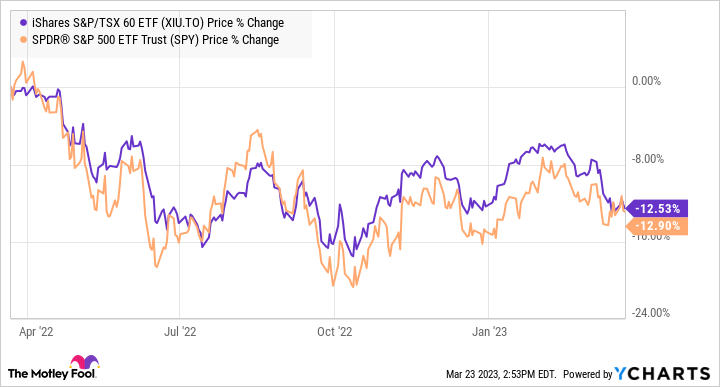

The stock market has been discouraging for investors recently. In the last 12 months, the Canadian and U.S. stock markets have declined approximately 13%.

XIU and SPY data by YCharts

Let’s recall that the ups and downs of the market are dictated, at a high level, by the ups and downs of the economic cycle. More accurately speaking, the stock market tends to run ahead of the economic cycle. The economic cycle occurs in a sequence of expansion, peak, contraction, trough, and recovery. Currently, we appear to be at the peak of an economic cycle that could be rolling over into a contraction phase that could turn into a recession. Particularly, inflation has been relatively high that is being countered by higher interest rates, which, in turn, has resulted in bond and stock prices falling.

The banking crisis, which started from the failure of some U.S. regional banks, paints a gloomy picture for the economy. The crisis increases the likelihood of a U.S. recession, which increases the probability of a recession occurring in Canada, because the U.S. is Canada’s largest trading partner.

While this sounds depressing, it’s the perfect time to reiterate the importance of focusing on investing for the long haul. Through economic cycles, the stock market tends to go up. Both the Canadian and U.S. stock markets have gone up in the last 10 years, as shown in the graph below. For reference, according to Investopedia, the average U.S. economic cycle has been about 5.5 years since 1950.

XIU and SPY data by YCharts

This is why we encourage long-term investing. By staying invested and perhaps even investing more (within one’s capability) in a market downturn, we will participate in the inevitable bull market that will eventually come after a bear market.

Here is one top Canadian stock that’s worthy to be considered for buying and holding forever.

TD stock

Toronto-Dominion Bank (TSX:TD) stock is down about 25% in the last 12 months, underperforming the market. At $77.28 per share at writing, the quality Canadian bank stock is undervalued by about 23% according to the analyst consensus 12-month price target. As well, it offers a solid dividend yield of close to 5%.

TD Bank has a long history of paying dividends since 1857. Its payout ratio was about 43% of its adjusted earnings last year. Additionally, it has $73.5 billion of retained earnings. Therefore, the bank stock has plenty of buffer to protect its dividend.

The blue-chip stock could very well continue to be weighed down in a potential recessionary scenario. However, investors must pull the trigger at one point. No one knows where the bottom may be. We can only guess.

Instead of investing in a lump sum, it’s more rational and also cautious to build a position over time. For example, you can buy a certain amount every month or every few months. You can even buy, say, $25 a week, if you don’t mind the hassle, through commission-free platforms like Wealthsimple.

Ensure your portfolio is diversified. Here are some of the best Canadian stocks to buy in a downturn.