Building wealth over the long term is essential if you want to retire someday, but the overall process isn’t always clear cut or intuitive.

To maximize returns and minimize risk, you might want to adopt the Motley Fool approach, which focuses on diversification and long-term planning while steering clear of short-term, risky investments. This is especially so in a Tax-Free Savings Account (TFSA) and Registered Retirement Savings Plan (RRSP), where capital losses can’t be claimed to offset taxes.

In this article, we’ll explore the advantages of a time-tested, straightforward investment strategy: holding a low-cost, highly diversified exchange-traded fund (ETF) that tracks the S&P 500 index, consistently making modest contributions, and reinvesting dividends.

A lesson from history

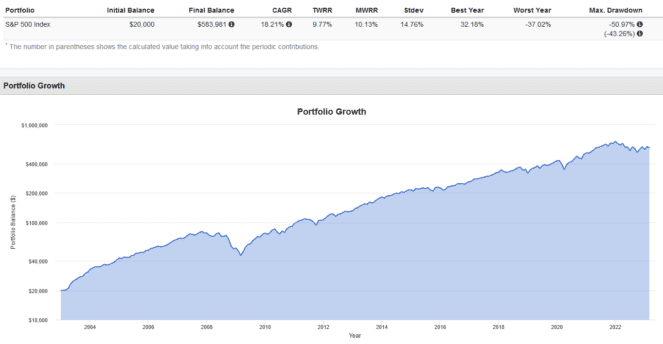

Let’s imagine you began investing 30 years ago in 1993 as a 25-year-old with $20,000 available. Unsure of which stocks to choose, you opted for a one-size-fits-all strategy by investing in an ETF that tracked one of the most long-standing and reliable indexes, the S&P 500.

By doing this, your $20,000 investment was put into a portfolio of 500 U.S. companies from 11 stock market sectors, where the winners rose to the top and the losers were cut from the index. You also committed to reinvesting $500 every month and reinvesting any dividends promptly.

You held this portfolio through both good and bad times, never succumbing to panic-selling, even during market crashes in 2000, 2001, 2002, 2008, 2018, 2020, and 2022. Fast forward to January 2023, your portfolio value would have looked like this:

By doing nothing more than holding and reinvesting dividends, your portfolio earned a 9.77% annualized return over 30 years, which is difficult for most investors to beat. After accounting for the periodic contributions, your overall return clocked in at 16.21%. You now have $583,961.

You achieved this doing nothing more than holding a low-cost index ETF, consistently investing more, reinvesting dividends, and never panic selling. You didn’t have to do any research, pick stocks, or actively trade. It’s as lazy and effective as investing gets.

Which ETFs to use?

Canadians have two index ETF options for investing in the S&P 500. Both options are from Vanguard, with one being a Canadian-listed ETF and the other a U.S.-listed ETF.

For an RRSP, the ETF to use is Vanguard S&P 500 ETF (NYSEMKT:VOO). As a U.S.-listed ETF, VOO isn’t subject to the Internal Revenue Service’s 15% foreign withholding tax on dividends if held in an RRSP. VOO also charges a very low expense ratio of 0.03%.

For a TFSA, the ETF to use is Vanguard S&P 500 Index ETF (TSX:VFV). This ETF is traded in Canadian dollars. The TFSA isn’t exempt from foreign withholding tax, so there are no benefits to converting currency and holding VOO here. VFV’s expense ratio is slightly higher at 0.08%.

In conclusion, VOO and VFV are uncomplicated yet widely diversified investments available at a low cost. They make excellent core portfolio holdings. To enhance diversification further, consider adding a few Canadian stock picks alongside VOO and VFV (and the Fool has some fantastic suggestions below).