Turning $100,000 into $1 million may sound like a lofty goal, especially when considering retirement savings. However, with discipline, a long-term mentality, and the right investments, it’s a target that’s within reach for many investors.

The path to achieving this remarkable growth isn’t just about picking the hottest stocks or jumping on the latest trends. It requires a thoughtful approach — one that makes the right conditions work for you.

Investors looking to grow their portfolios must consider essential factors like low fees, steady, uninterrupted compounding, and taking the right amount of risk. Striking the perfect balance between these elements can be the key to unlocking significant growth over time.

In this article, I’ll be presenting four investment options that have historically turned $100,000 into $1 million. These strategies have stood the test of time, and they can be easily replicated today using exchange-traded funds (ETFs).

Option #1: The S&P 500

The S&P 500 is a market capitalization-weighted index of 500 of the largest publicly traded companies in the United States. It serves as a benchmark for U.S. stock performance and is often considered a reliable gauge of the overall U.S. stock market. Investing in the S&P 500 means buying into a diversified array of companies across various sectors, providing balanced exposure to the overall American economy.

A prime way to invest in the S&P 500 is through Vanguard S&P 500 ETF (TSX:VFV). What makes VFV an ideal tool for this investment strategy is its incredibly low expense ratio of just 0.09%. This minimal fee means more of your money is working for you, compounding over time without being heavily eroded by costs.

Option #2: Investing in small-cap stocks

Small-cap stocks represent companies with a smaller market capitalization, typically ranging from $300 million to $2 billion. These companies often have significant growth potential, but they come with added risks when compared to their large-cap counterparts. Historically, the extra risk of the size factor in small-cap investments has led to higher returns, particularly during bullish market phases.

For investors interested in exploring the small-cap universe, BMO S&P US Small Cap Index ETF (TSX:ZSML) is an excellent option. This ETF offers broad exposure to small-cap stocks via the S&P SmallCap 600 Index at a 0.23% expense ratio.

Option #3: Investing in the total U.S. stock market

For investors seeking even broader diversification, the total U.S. stock market offers an encompassing exposure. The advantage of investing in the total U.S. stock market lies in its extensive diversification, including companies of all sizes and sectors. This mix offers potential for consistent growth while mitigating some of the risks associated with focusing solely on one segment of the market.

A standout option for investing in the total U.S. stock market is iShares Core S&P US Total Market Index ETF (TSX:XUU). With an incredibly low expense ratio of 0.08%, XUU provides access to the vast array of companies in the U.S. market under a single investment umbrella.

Option #4: Investing in REITs

Real estate investment trusts, or REITs, offer a unique pathway to investment growth, particularly appealing to those interested in the real estate sector. REITs are companies that own, operate, or finance income-generating real estate across a range of property sectors. They allow individual investors to buy shares in commercial real estate portfolios that receive income from various properties, such as apartments, office buildings, shopping centres, and more.

For Canadian investors looking to tap into the potential of REITs, CI Canadian REIT ETF Fund (TSX:RIT) offers an attractive option. This ETF provides exposure to North American REITs, with a focus on the Canadian market. Investing in RIT gives access to a diversified portfolio of real estate assets, capturing the growth and income possibilities inherent in this sector.

The historical results

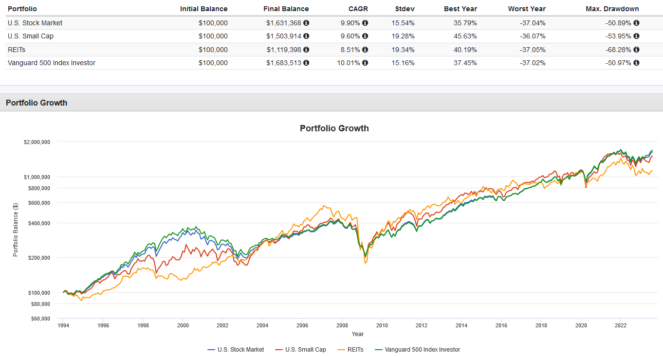

Here’s a backtest of all four of the mentioned investment options, spanning from 1994 to the present date. It’s crucial to understand that this backtest is a historical simulation and should be treated with caution.

- S&P 500: 10.01% return. $1,683,513 ending value

- REITs: 8.51% return. $1,119398 ending value

- Small-caps: 9.60% return. $1,503,914 ending value

- U.S. stock market: 9.90% return. $1,631,368 value