Since 2009, the tax-free savings account, or TFSA, has been a vital part of any investment strategy. This is due to the significant tax savings that the TFSA brings, which goes a long way towards building up our passive income streams. Thus, the goal should be to take full advantage of the $88,000 cumulative TFSA contribution limit.

Here’s how to use your TFSA to earn $350 a month in passive income.

Fixed income, or bonds, have a place in a well-diversified TFSA portfolio

Interest income is income that is paid to holders of bonds, GICs, or any fixed income security. Today, these investments are significantly more attractive than they were only two years ago. With rates exceeding 5% on even the safest of fixed income securities, this is an investment class that you should consider in your quest for passive income.

Moreover, interest income is taxed at a higher rate than dividend income. More specifically, interest income is fully taxable, while dividend income is eligible for a tax credit. This means that a taxpayer in the highest tax bracket would pay up to 37% tax on their interest income. On the other hand, there is a maximum tax of 23.8% on qualified dividends. As a result, we can see that in general, it makes a lot of sense to shelter your higher taxed interest income in your TFSA.

Fortis: The king of passive income for your TFSA

Fortis Inc. (TSX:FTS) is a $29 billion utility giant with a diverse geographic footprint and asset mix. Its regulated assets have backed its reputation of being a steady, predictable dividend payor that has provided generous and growing dividends to its shareholders for 50 years.

Looking ahead, management is targeting a 4% to 6% dividend growth rate through to 2027. This growth rate is underpinned by steady growth in Fortis’ customers and rates. This dividend growth adds up over time, and as it does, so does your passive income.

Enbridge stock: A 7.78% yield provides a passive income windfall

On the higher yielding side, we have Enbridge Inc. (TSX:ENB), one of North America’s leading energy infrastructure companies. While Enbridge’s business has been more challenging than Fortis’, its cash flow is also predictable. Additionally, it’s largely inflation-protected.

Enbridge has 28 years of annual dividend increases under its belt. During this time period, its annual dividend has grown at a CAGR of 7.25%, to the current $3.55 per share. Essentially, the dividend today is 1,320% higher than it was in 1995. This is another ideal candidate for investors looking for passive income.

The math

So back to my initial question – how do we earn $350 a month in passive income?

While I felt it necessary to acknowledge that bonds have their place in your TFSA account, I would rather focus on generating growing passive income with reliable, growing dividends. So, in order to make $350 a month in passive income, here’s what to do:

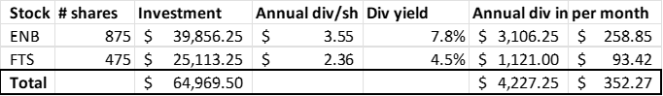

Buy 875 shares of Enbridge stock, which will give you $258.85 in monthly passive income. Then, buy 475 shares of Fortis stock, which will give you $93.42 in monthly passive income. Depending on your risk profile and which stock you’re more comfortable with, you can alter the amounts to generate more or less passive income.

Bottom line

Enbridge and Fortis are two stocks that have long histories of providing reliable dividend income. This track record gives us comfort in their ability to provide lasting and growing passive income for your TFSA. Also, these are essential businesses, which have the staying power and outlook that we can count on. Try to make full use of your TFSA contribution limit today.