Are you looking to introduce more choices and freedom in your life? Do you have a nagging desire to gain financial freedom to rid yourself of the burden of toiling away to pay your bills? If you answered yes, then it’s time to start building your passive-income stream.

Think big when it comes to passive income

To achieve the financial freedom we all desire, we have to think big. This means sacrifice. And it means being disciplined and consistent. But it’s called passive income because after the work required to find the right opportunity and after the initial investment, you just have to sit back and collect.

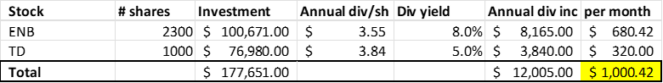

To start off, a goal of $1,000 a month in passive income is significant but also achievable. In time, you will build from there, but that’s a good starting point. So, how much money would it take to achieve this level of passive income?

It all depends on expected returns

The amount of money you will need to invest will be dependent on the returns of the stocks you invest in. The trick is to find the right balance between risk and reward. Also, we want stocks that pay reliable and growing dividends, as this will sustain the passive income for years to come.

Thankfully, I have two ideal stocks for this purpose.

Enbridge stock

With a current dividend yield of 8%, Enbridge (TSX:ENB) is one of two passive-income ideas I will discuss in this article that are good for building up your passive income.

In fact, it’s been supplying investors with solid dividend income for many years now. Enbridge has 28 years of annual dividend increases under its belt. During this time period, its annual dividend has grown at a compound annual growth rate (CAGR) of 7.25% to the current $3.55 per share. Essentially, the dividend today is 1,320% higher than it was in 1995. Also, Enbridge stock is also more than 1,000% higher in the same time period.

More recently, Enbridge’s results have continued to show that the business continues to perform well. In the first six months of 2023, Enbridge’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) increased 8% to $8.5 billion. Also, its distributable cash flow was $5.9 billion. Hence, we can continue to have faith in Enbridge’s dividend.

TD Bank stock

Toronto-Dominion Bank (TSX:TD) is another Dividend King that investors have been able to rely on for passive income for decades. This is evident in TD Bank’s dividend history and its solid returns.

In fact, since the 2008 credit crisis, TD Bank’s dividend has grown almost 240%. That’s a CAGR of 8.4%. It’s an example of a company that has been able to thrive in the long run and through crises. It should give us confidence in the strength of TD Bank and of the Canadian banking system in general.

Despite the rising credit losses and economic turmoil that lies ahead, TD Bank is a well-capitalized bank that has shown us that we can rely on its dividend. Hence, we can comfortably use it for our passive-income goals.

So, how much do you have to invest?

As you can see from the chart below, you would need to invest $177,651 to achieve $1,000 a month in passive income. Of course, the details would be up to you, and this would look different depending on which stocks you would buy and how you wanted to split your holdings. In my example, I assume buying Enbridge and TD Bank stocks in order to arrive at a monthly passive income of $1,000.

The bottom line

Imagine how much money you could save if you forego the unnecessary purchases that we’re all guilty of making every day. The savings add up, and in time, you can amass a lump sum of money that can make a real difference in your life.

With a little planning, sacrifice, and patience, generous passive income streams can be yours. Investing $177,000 today in my two passive income ideas can give you $1,000 per month.