The Tax-Free Savings Account, or TFSA, is an extremely useful tool to help maximize your retirement savings. For 2024, the TFSA contribution limit has been raised to $7,000, from $6,500 in 2023. This makes the cumulative TFSA contribution room a grand total of $95,000. Clearly, investors have increasingly more TFSA contribution room to generate healthy retirement income.

Here’s how to earn $100 each month.

TFSA stock #1: Northland Power

With a dividend yield of 5.5% and a long history in the renewables space, Northland Power (TSX:NPI) is a solid option for monthly income. The company pays a monthly dividend and has been doing so for a long time. In fact, Northland’s dividend has been steady, reliable, and predictable since 2005. This profile represents a good fit for your TFSA.

However, shares of Northland Power have been weak lately as rising interest have taken a toll. This, along with rising costs caused the company’s financials to suffer. In the five years ended 2022, Northland had been humming along nicely. In fact, its operating cash flow increased at a compound annual growth rate (CAGR) of 13.6%, as revenue increased 57% or at a CAGR of 9.5%. Then in 2023, things took a shift for the worse as power prices fell from their 2022 highs, inflation escalated, and interest rates rose.

Yet, if we take a step back and focus on the long term, we can see a bright picture. Northland has produced electricity from clean-burning natural gas and renewable resources for 35 years. The company has clean-burning natural gas, wind, and solar assets in places such as Asia, Europe, and North America. This is a growing industry, and Northland has grown right along with it.

TFSA stock #2: Northwest Healthcare REIT

The other monthly dividend payor that can help you achieve $100 in monthly dividend income is Northwest Healthcare Properties REIT (TSX:NWH.UN). This stock is currently yielding 8%. While there’s still some risk due to high debt loads, the long-term fundamentals of this real estate investment trust are hard to pass on.

Firstly, Northwest is the owner and operator of healthcare properties around the world, and this is a highly defensive business. Secondly, the company’s buildings are characterized by long-term tenancy, with a weighted average lease expiry of 14 years. Finally, Northwest Healthcare’s revenues are inflation indexed.

However, Northwest recently got into trouble due to its heavy debt load and was forced to cut its dividend, which is never a good thing. However, the company sold non-core assets, and this is making a significant dent in the debt load. At this time, Northwest’s dividend payments equate to under 50% of its cash flow versus over 130% previously.

The math

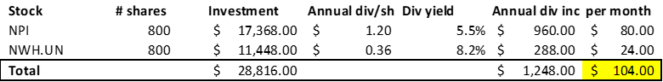

As you can see from the table below, investing a total of $28,816 of your TFSA savings into these two stocks will give you a monthly income of $104.

In conclusion, investors looking to make good use of their TFSA contribution limit for extra income should consider the two stocks that I’ve covered in this article. Their dividend yields are significant, and they’re backed by strong long-term growth businesses. This tax-free income can be an important source of monthly retirement income you can count on.