Dollarama Inc. (TSX:DOL) is Canada’s leading value retailer with a long history of value creation for both consumers and shareholders. In recent years, this value proposition has become increasingly relevant and appreciated. Along with this, Dollarama stock has skyrocketed to new heights.

I have long been troubled by Dollarama stock’s valuation. I’ve therefore admittedly missed out on this great deal. Let’s take a look back to see how much money we would have today if only we had invested in Dollarama in 2019.

Dollarama (DOL) stock goes ballistic

The last few years have been good to Dollarama. First, we had the pandemic. During the pandemic, many stores were forced shut, but Dollarama was considered an essential business. Therefore, it benefitted immensely during this time. Next, we had soaring inflation and interest rates. This made consumers ever more value conscious. Again, Dollarama has been a winner in this environment.

In fact, since 2019, Dollarama has seen its revenue rise by more than 42%, and its net income increase by 47%. This was accompanied by a 210% increase in Dollarama’s stock price.

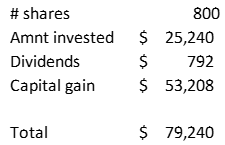

This means that if we had invested $25,240 in DOL stock in 2019, this would be worth $79,240 today. As you can see from the table below, the capital gain would be $53,000, with some dividends adding to the total return.

Valuation remains high

This look back is an interesting exercise. It allows us to contemplate on our decisions, and figure out where we went wrong and what we can learn from it. The goal is to never beat ourselves up for mistakes made, but to learn from the experience so we can do better in the future.

So, let’s reconsider Dollarama stock today. Is it still a buy after its fantastic rise? Or is its lofty valuation finally about to catch up with it?

One thing that is evident is that Dollarama’s results have been increasingly justifying its valuation. Today, the stock trades at 27 times this year’s expected earnings, and 24 times next year’s expected earnings.

This is high for a retailer, but considering that Dollarama is expected to post earnings growth of 25% in 2024, it might be reasonable. The problem arises in 2025, when earnings growth is expected to fall dramatically to 12%. This is by no means a bad result, just not in line with what the stock seems to be pricing in at this time.

The consumer remains at risk

Despite current expectations that interest rates will be coming down in 2024, it remains evident that the consumer is not in a good place and the economy is at risk. This, in my view, is a risk for Dollarama. While essential products make up a large portion of Dollarama’s revenue, the company also sells general merchandise, which can be hit as consumers rein in their spending.

This means that Dollarama’s earnings estimates might not continue increasing so rapidly, tilting the risk/reward on Dollarama stock. Even though the stock still looks good on a long-term basis, the short-term outlook is likely less positive.

In conclusion, if you’re looking at investing in Dollarama to get in on this success story, I would wait to add when Dollarama’s stock price is trading at lower levels.