Brookfield Infrastructure (TSX:BIPC) and Brookfield Renewable (TSX:BEPC) are both stocks in the utilities sector. Their parent company and general manager, Brookfield Corp., has substantial stakes in utility stocks and generates nice income from them. Investors can grab their share of the income, too. But which Brookfield stock is a better buy?

BIPC data by YCharts

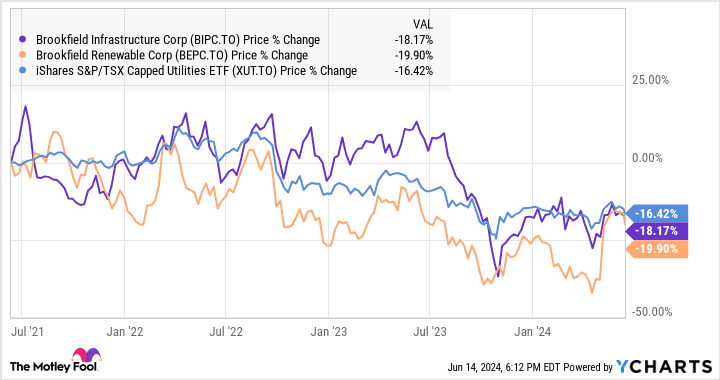

Both utility stocks are down meaningfully over the last few years, as shown in the YCharts above. Based on the stock price, the stocks underperformed the utility sector (using the iShares S&P/TSX Capped Utilities Index ETF as a proxy).

The sector has been pressured by higher interest rates since 2022. Because utilities have large debt levels on their balance sheets, their interest expenses are expected to rise in a higher interest rate environment.

Although the Bank of Canada has cut the policy interest rate by 0.25% earlier this month, it is the general belief that the central bank will not significantly reduce the rate quickly. There’s simply no catalyst for that. Besides, there’s always a lag period for interest rate cuts to trickle down to businesses. Furthermore, both utilities are global with big parts of their operations in other countries. So, the central bank actions in those countries impact their interest expense even more.

BIPC Total Return Level data by YCharts

Let’s keep in mind that investor returns come from any booked price gains along with any dividends received. The utility stock returns were less painful when dividends were accounted for, as shown in the above chart. That said, the broader Canadian stock market (using the iShares S&P/TSX 60 Index ETF as a proxy) still outperformed the sector and utility stocks in the period.

This suggests that given the right environment, the utility sector and the stocks could outperform the market. A big part of what attracts long-term investors is the compelling yields often offered by utility stocks.

At writing, Brookfield Infrastructure stock and Brookfield Renewable stock yield 4.8% and 4.7%, respectively. So, there’s only a small difference. We can count a small win for Brookfield Infrastructure for having a slightly higher yield.

Investors can also consider investing in their limited partnership units, which are economically equivalent to the corporation shares, for higher cash distribution yields. Brookfield Infrastructure Partners L.P. yields almost 5.9% whereas Brookfield Renewable Partners L.P. yields 5.6%. As a benchmark for comparison, the XUT exchange-traded fund yields about 3.7%.

Notably, Brookfield Infrastructure Partners has historically delivered higher cash distribution growth. For instance, its 10-year cash distribution growth rate is 8.3% versus Brookfield Renewable Partner’s rate of 5.7% in the period.

Brookfield Infrastructure owns and operates a diversified portfolio of critical infrastructure assets that help move and store energy, water, freight, passengers, and data. It focuses on quality and essential assets that allow it to target organic growth of 6 to 9% that supports funds from operations growth and its growing cash distribution.

Brookfield Renewable has a diversified portfolio of hydro-, wind-, and solar-powered assets, as well as distributed energy and sustainable solutions.

Valuation-wise, analysts generally believe Brookfield Infrastructure is more attractive with a discount of about 27% versus the 13% discount of Brookfield Renewable. So, at the moment, Brookfield Infrastructure stock appears to be a better buy.