Earning $500 a month in dividends might sound modest, but consider this: it translates to $6,000 a year in passive income.

If you’re working full-time, typically around 2,087 hours annually, that’s effectively a $2.87 per hour raise. With the median hourly wage in Canada around $30, you’re looking at a 9.5% increase—all without lifting a finger.

Here’s how you can achieve this with a special TSX-listed closed-end fund (CEF) that delivers consistent monthly income.

What to buy

Canoe EIT Income Fund (TSX:EIT.UN), Canada’s largest closed-end fund with $2.94 billion in assets, is the tool for the job.

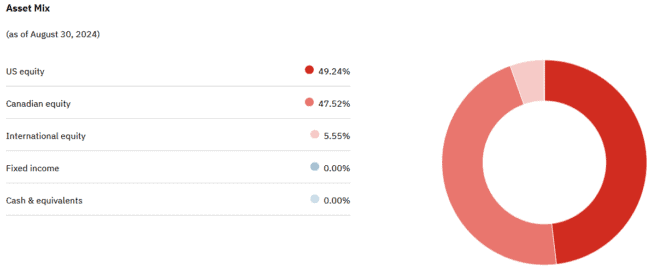

It trades like a stock but offers much greater diversification. It maintains a balanced portfolio, roughly split 50/50 between Canadian and U.S. stocks.

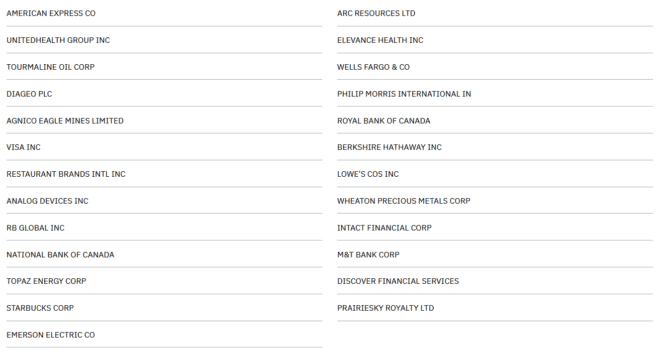

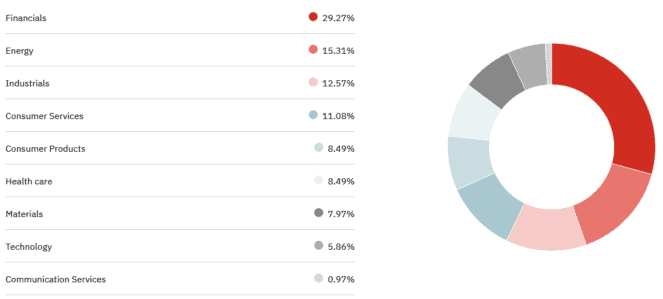

The top 25 holdings, making up 77.34% of its total assets as of August 30, represent a variety of major sectors, notably financials, energy, and industrials.

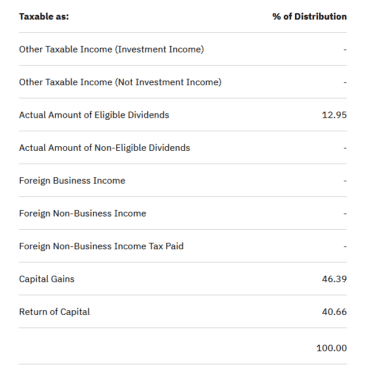

The primary aim of EIT.UN is income generation, targeting a consistent monthly distribution of $0.10 per share, a rate it has maintained for over a decade. These payments are funded through dividends, capital gains, and the return of capital, providing a reliable income stream for investors.

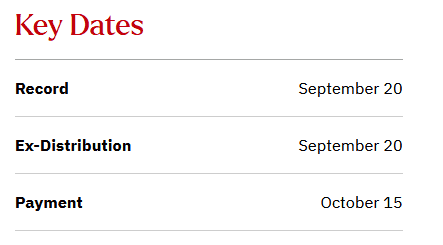

Typically, the fund goes ex-distribution in the middle of each month, with the actual payment following in the middle of the subsequent month.

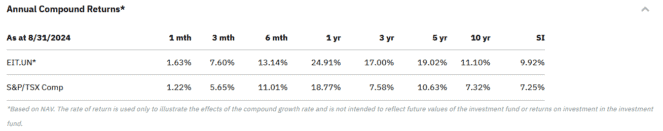

Over the last 10 years and since its inception, EIT.UN has strongly outperformed the S&P/TSX Composite Index with dividends reinvested.

What to watch out for

However, EIT.UN differs significantly from a typical exchange-traded fund (ETF) or single stock, mainly for two reasons.

First, it uses leverage to enhance returns, typically around 20% or 1.2x. This leverage introduces greater volatility and higher risk, but it also opens the door for potentially higher returns.

Second, it’s crucial to consider the market price of EIT.UN relative to its net asset value (NAV). As of September 12, the NAV per share stands at $14.67, while its market price is $14.29.

This indicates that the shares are trading at a discount. It’s generally advisable to buy at a discount rather than at a premium to avoid paying more than the fund’s underlying assets are worth.

How much to invest

Assuming EIT.UN’s most recent September 15th monthly distribution of $0.10 and the current share price at the time of writing of $14.29 remained consistent moving forward, an investor using a Tax-Free Savings Account would need to buy roughly $71,450 worth of EIT.UN, corresponding to 5,000 shares, to receive around $500 monthly tax-free.

| ETF | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| EIT.UN | $14.29 | 5,000 | $0.10 | $500 | Monthly |