There’s no one-size-fits-all answer when it comes to the “best” exchange-traded fund (ETF), but let me offer you my take.

For me, the most appealing ETFs, particularly for beginners and those looking for long-term investments, are those with low fees and broad diversification.

BMO Global Asset Management offers a couple of ETFs that check these boxes perfectly, and you can grab shares of each for less than $100 on the TSX.

If you prioritize steady growth and minimal fuss, these ETFs could be just what you’re looking for. Here’s what you need to know.

BMO S&P 500 Index ETF

My first pick is the BMO S&P 500 Index ETF (TSX:ZSP) which, as the name suggests, tracks the S&P 500 Index.

This index is a benchmark for U.S. equities, representing 500 of the largest companies selected based on criteria like market size, liquidity, and financial viability, among others.

The ETF is market-cap weighted, meaning that companies with the largest market capitalizations have a bigger impact on the index’s performance.

This typically results in sectors like technology, financials, communications, consumer discretionary, and healthcare being prominently represented in the top holdings.

What I appreciate about ZSP is its cost-effectiveness. It offers exposure to the bulk of the U.S. stock market with a management expense ratio (MER) of just 0.09%.

For someone investing $10,000, that translates to about $9 in fees annually, which is a bargain considering the diversification and potential returns it offers.

BMO S&P/TSX 60 Index ETF

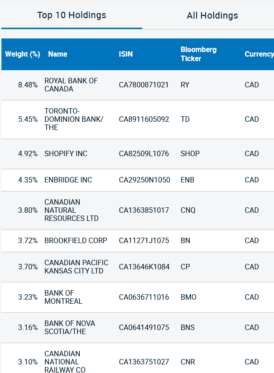

The Canadian market counterpart to ZSP is the BMO S&P/TSX 60 Index ETF (TSX:ZIU), which tracks the S&P/TSX 60 Index.

This index mirrors the performance of 60 large Canadian stocks. Due to the nature of the Canadian market, there’s a pronounced concentration in financials and energy, which are dominant sectors in our economy.

I appreciate ZIU for a couple of reasons: it packages the most prominent blue-chip Canadian stocks into a single investment and also offers a solid dividend yield of 2.8%.

While ZIU is slightly pricier than ZSP with a management expense ratio (MER) of 0.15%, it’s still quite affordable – investing $10,000 in ZIU incurs just $15 in annual fees.

The Foolish takeaway

Pairing ZSP and ZIU will give you a complete North American stock portfolio focused on blue-chip stocks at a low cost. For example, a 75% ZSP and 25% ZIU allocation will have a weighted average MER of just 0.105%.

Both ETFs can be purchased for less than $100 each. As of October 9th, ZSP costs around $85 per share and ZIU costs around $55 per share.