There aren’t many monthly dividend stocks listed on the TSX. The few available are largely royalty income trusts or real estate investment trusts (REITs), which often suffer from a lack of diversification.

One notable exception is the Canoe EIT Income Fund (TSX:EIT.UN). While not technically a stock, it trades on the TSX just like one, making it easy to buy and sell. As of November 20, it has a 7.7% yield.

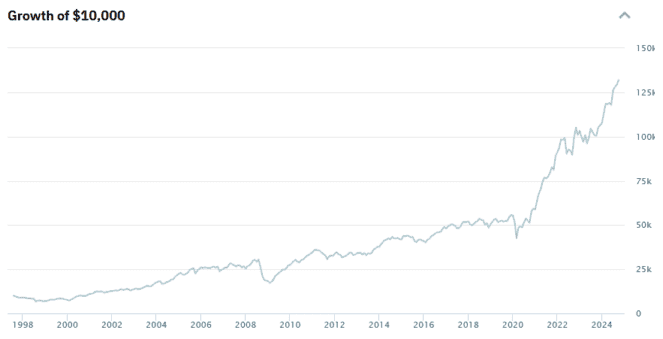

As its name suggests, EIT.UN focuses on income generation. It has been paying monthly distributions since August 1997 and now boasts $2.9 billion in assets. Here’s what you need to know before investing.

What is EIT.UN?

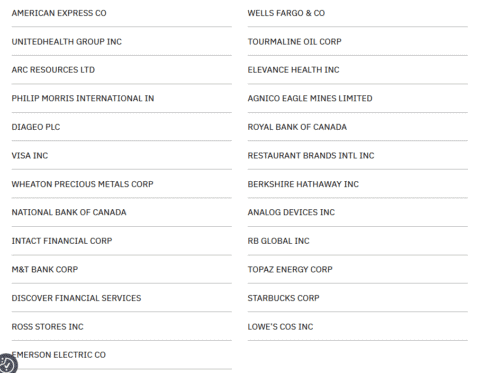

EIT.UN might look like a stock when you’re buying and selling it on the TSX, but it’s actually a fund. Its portfolio is split evenly, holding about 50% Canadian stocks and 50% U.S. stocks.

What makes EIT.UN stand out is that it’s actively managed. This means real people—professional fund managers—are picking and adjusting their investments rather than simply following an index.

The main goal of EIT.UN is to provide a steady monthly income. For over 10 years, it has paid a reliable $0.10 per share every month. The last ex-dividend date was on November 22, with a payout date scheduled for December 13.

That income comes from a mix of dividends, capital gains, and a return of capital, which makes it not only consistent but also tax-efficient for investors.

And it’s not just about income. Unlike some other income-focused funds, EIT.UN has delivered strong total returns, too.

With distributions reinvested, the fund has compounded at an impressive annualized rate of 11.68% over the last 10 years, easily outperforming the S&P/TSX 60 Index, which delivered 8.41% over the same period.

EIT.UN: Risks to be aware of

Like any investment, EIT.UN isn’t without its risks. Here are a few key points to keep in mind before adding it to your portfolio.

First, the market price of EIT.UN doesn’t always match its net asset value (NAV). NAV represents the value of the fund’s holdings, but the price you pay on the TSX can be higher (a premium) or lower (a discount). It’s a good idea to check this before buying—ideally, aim to buy at a discount for better value.

Second, EIT.UN comes with relatively high fees. Its total management expense ratio (MER) is 2.12%, which is similar to many mutual funds. While the management fee is 1.1%, the overall MER is higher due to the fund’s borrowing strategy.

Speaking of borrowing, EIT.UN uses leverage, meaning it can borrow up to 20% of its NAV to enhance returns and boost its yield. While this strategy can amplify gains, it also makes the fund more volatile and increases risk. Plus, the interest paid on the borrowed funds adds to the higher MER.

Finally, while the $0.10 per share monthly distribution has been a hallmark of EIT.UN for years, it’s also a double-edged sword. The steady payout hasn’t increased over time. As the cost of living rises, the purchasing power of the distribution decreases, which can be a concern for long-term income-focused investors.

Understanding these risks helps ensure you’re making an informed decision. For the right investor, EIT.UN’s potential rewards can still make it an appealing choice, but it’s crucial to weigh these factors carefully.