All Canadians who turn 18 or older in 2025 get an extra $7,000 worth of Tax-Free Savings Account (TFSA) contribution room this year. This room is a considerable addition to the total for most Canadians. You accumulate TFSA contribution room every year in which you are eligible to open an account. You do not need to actually have an account to accumulate room. So, if you’re just contemplating opening a TFSA for the first time this year, you may have more room than you think. In this article, I will explore the $7,000 worth of TFSA contribution room that was added this year and what it means to Canadians.

What the $7,000 number really means

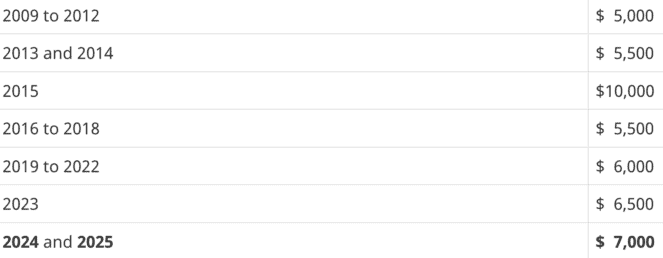

The fact that an extra $7,000 worth of TFSA contribution room is being added this year does not mean that your TFSA contribution room is exactly that much. Your available room is the amounts added in all the years you were eligible to open an account, less contributions you’ve already made, plus withdrawals made more than a year ago. So, your TFSA contribution room varies quite a bit depending on your individual circumstances. However, if you haven’t contributed to a TFSA yet, your TFSA contribution room is pretty easy to determine. It is all the sums added in the years you were eligible to open an account, which can be determined using the table below:

As you can see, quite a bit of TFSA contribution room has been added since the account was created in 2009. Note that the amounts listed under “year to year” are annual figures, not cumulative totals. The cumulative amount for 2009 to 2012 was actually $20,000, not $5,000.

Using this information, you can determine how much TFSA contribution room you have accumulated. If you were 18 or older in 2009, you have accumulated $102,000 worth of TFSA contribution room to date. If you turned 18 last year, you have accumulated $14,000 worth of room. If you turned 18 in 2022, you have accumulated $26,500 worth of room. Of course, “accumulated” is not the same as “available”: your available room is affected by past contributions and withdrawals. To find out exactly how much TFSA contribution room you have today, head on over to CRA MyAccount. It has all the TFSA information you need.

How to invest your TFSA

Having explored the matter of 2025 TFSA contribution room, we can now proceed to the next logical topic:

How to invest the room you have.

There are two good options for all novice investors to consider:

Guaranteed Investment Certificates (GICs) and index funds. GICs are bond-like investments offered by banks. They yield about 3.5% today, which is higher than the last reported Consumer Price Index inflation rate. Up to $100,000 worth of GICs are insured by the government, making them nearly risk-free.

Index funds are diversified stock portfolios that trade on the stock market. A good example of an index fund is iShares TSX 60 Index Fund (TSX:XIU). It is a low-cost ETF that tracks the TSX 60 Index — the 60 largest TSX companies by market capitalization.

60 stocks is a decent amount for diversification, which makes XIU less risky than most individual stock holdings. The fund also benefits from a relatively low 0.12% management fee and high liquidity (the more liquid an ETF is, the less you pay to market makers). These characteristics make XIU a fairly desirable investment. So, index funds are very sensible investments for novice investors.