I’ll save you the trouble – there’s absolutely nothing worth knowing about Canadian healthcare stocks in 2025. Why? Because the sector barely exists.

The TSX has only a handful of small-cap healthcare companies, and nothing remotely comparable to the giants in the U.S. and Europe that dominate pharmaceuticals, biotech, and medical technology.

Read on for a look at the paltry healthcare exposure the TSX offers – and an exchange-traded fund (ETF) alternative that provides real healthcare exposure along with a high yield and monthly dividends.

The laughable state of Canadian healthcare stocks

Canada has a robust public healthcare system, but when it comes to healthcare stocks, the market is severely lacking. The TSX is rich in financials, energy, and industrials, but fairly devoid of other sectors.

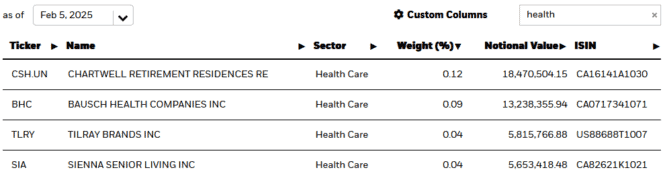

A quick search of the benchmark S&P/TSX Composite Index reveals a grand total of four healthcare companies. That’s four out of more than 250 stocks—a rounding error compared to other sectors and inconsequential.

And the lineup isn’t exactly inspiring. There are two retirement home operators (which are arguably more real estate than healthcare), a cannabis company that isn’t profitable, and the husk of what was formerly Valeant, now best known for making contact lens fluid.

That’s the extent of Canadian healthcare exposure. If you’re looking for real investments in this sector, you’ll need to look elsewhere. There are some smaller biotech firms, but those tend to be very risky penny stocks I wouldn’t touch with a 10-foot pole.

Buy this healthcare ETF instead

Forget the TSX healthcare sector and look to the U.S., where the medical-industrial complex might exploit average people but is immensely profitable for investors.

The ETF I like here is the Hamilton Healthcare YIELD MAXIMIZER™ ETF (TSX:LMAX).

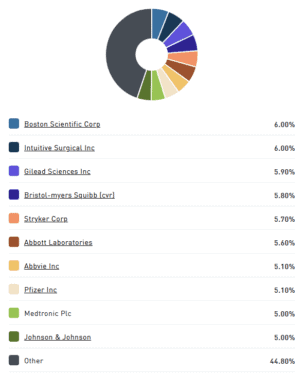

LMAX holds 20 of the largest U.S. healthcare stocks, equally weighted at rebalance, providing diversification across medical technology, pharmaceuticals, biotech, and insurance.

To generate high income, LMAX sells covered calls on 30% of the portfolio, while keeping 70% uncovered for growth. This strategy sacrifices some price appreciation but provides steady monthly distributions.

Right now, LMAX pays $0.156 per share monthly. At a share price of $15.95 as of February 6, that works out to an 11.7% annualized yield – a solid return for investors looking for high-yield healthcare exposure.