While the Magnificent Seven stocks and other U.S. tech and growth stocks crash and burn under Trump’s idiotic tariffs, Canadian stocks are holding up far better – especially dividend payers.

There are good reasons to own Canadian dividend stocks in your portfolio, and no, patriotism isn’t one of them. The real advantage comes down to two major tax benefits that make these stocks incredibly attractive for Canadian investors.

Here’s why Canadian dividend stocks still make sense in 2025 – and a fund from Hamilton ETFs I prefer for easy exposure.

Qualified dividends

The Canada Revenue Agency (CRA) offers a major tax incentive to Canadians who invest in Canadian-domiciled businesses. This comes in the form of qualified dividends, which are taxed at a much lower rate than regular income.

Here’s how it works: Instead of paying your full marginal tax rate, qualified dividends benefit from the dividend tax credit, reducing the tax you owe. In some provinces, this can bring your effective tax rate on dividends close to 0% if you’re in a lower income bracket.

Even at higher income levels, you’ll still likely pay far less tax on Canadian dividends than you would on capital gains, interest income, or foreign dividends.

U.S. stocks, on the other hand, get no such tax break. In fact, as you’ll see shortly, there’s actually a hidden tax disadvantage that many investors don’t even realize.

Foreign withholding tax

The U.S. government normally withholds 30% of a company’s dividends for foreign investors. Thanks to a tax treaty, Canadians get a reduced rate of 15% – although who knows what Donald the whacko might do if he notices.

This means if you own a U.S. stock with a 1% dividend yield, you’re only getting 0.85% after withholding tax. Over time, that small reduction can significantly impact your compounding returns.

What’s worse is that this withholding tax still applies even in a Tax-Free Savings Account (TFSA) – a Canadian account where investment growth and withdrawals are normally tax-free. Since the tax is withheld at the source before the dividend even reaches your account, there’s no way to get it back.

The only way to avoid this tax is to hold U.S. dividend-paying stocks in a Registered Retirement Savings Plan (RRSP), which is exempt from U.S. withholding tax under the treaty.

My favourite Canadian dividend ETF

I like the HAMILTON CHAMPIONS™ Canadian Dividend Index ETF (TSX:CMVP), which pays dividends monthly and focuses on some of the strongest dividend-growth stocks in Canada.

CMVP tracks the Solactive Canada Dividend Elite Champions Index, which only includes companies that have grown their dividends for at least six consecutive years. On average, the stocks in this index have delivered 10% annualized dividend growth – a sign of strong, shareholder friendly businesses.

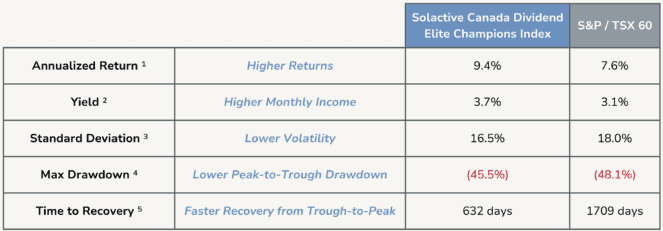

Historically, the index CMVP follows has outperformed the S&P/TSX 60, delivering higher returns, a higher yield, and lower risk. That makes it a great option for investors who want steady dividend growth without taking on unnecessary volatility.

CMVP is also one of the cheapest Canadian dividend ETFs available, with a 0.19% management fee. But through January 31, 2026, Hamilton is waiving this fee entirely, making the ETF virtually free to own for a while.