Investing in monthly dividend stocks is a great way to ensure a steady and regular monthly paycheque. But of course, we have to be careful to pick the right stock – the one that maximizes the dividend payment while minimizing the risk. Peyto Exploration and Development Corp. (TSX:PEY) is a dividend stock that can do just that.

Please read on to find out why Peyto stock is a great investment today for monthly income.

Why Peyto?

Behind every quality natural gas stock is a company that operates efficiently, with solid financial management. Once this exists, a company’s fate is not as heavily tied to underlying commodity prices.

In Peyto’s case, we have a natural gas producer that’s set up for success. Peyto is a key player in the Canadian natural gas market, with production approaching 125,000 barrels of oil equivalent per day (boe/d). Its assets are top quality, and can be found in one of Canada’s most prolific basins, the Alberta Deep Basin.

This basin has a high-return production profile, with high recoveries and predictability. This translates into lower risk and lower capital requirements. All good things for Peyto and its investors.

Canadian natural gas prices plummet in 2024

Canadian natural gas prices were weak and volatile in 2024. Thankfully, Peyto is diversifying its revenue into premium demand markets. Looking ahead, Canadian natural gas producers like Peyto will increasingly benefit from the liquified natural gas (LNG) market.

For example, LNG Canada is expected to begin shipments sometime in 2025. LNG Canada is located in Kitimat, British Columbia. This site offers many competitive advantages. For example, it boasts one of North America’s shortest shipping routes to Asia. Also, it’s a deep water, ice-free port. Finally, it has the necessary infrastructure, such as rail transportation and pipelines to transport natural gas to the facility.

Recent results showcase Peyto’s strengths

In 2024, Peyto’s cash flow from operations was $713 million. Also, Peyto delivered industry-leading cash costs, an operating profit of 66%, and a 24% profit margin. This happened despite natural gas price weakness in 2024. This performance is attributed to increased production volumes as well as hedging gains.

Today, the Canadian natural gas price has strengthened once again and is now trading above $1.60. In response to all of this, the shares of Peyto have rallied 15.5% in the last year and 47% in the last three years. And this is only the beginning, in my view, as secular trends are very supportive of a positive natural gas outlook.

So, how many shares should you buy for $100 in monthly income?

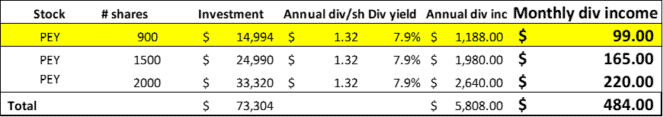

Currently, Peyto is yielding a very generous 7.9%. This means that in order to receive $100 per month in dividend income, you have to own 900 shares of Peyto stock. The total investment required for this is $14,900. See the chart below for the details and for how much dividend income you can make if you have more money to invest.

The bottom line

The natural gas industry is experiencing very positive secular trends at this time, such as the opening up of the North American natural gas industry to global markets. Within this positive industry development, a company like Peyto will benefit tremendously. In turn, this makes Peyto a top choice for monthly dividend income.