Suncor Energy (TSX:SU) is on a mission — to create value for all stakeholders. It’s a mission that has already resulted in big gains for both the company and Suncor’s stock price. In fact, the stock has risen 30% in the last three years.

Let’s take a look at what’s in store for Suncor Energy stock.

Source: Getty Images

Suncor rallies from lows

As I mentioned in my introduction, Suncor stock has rallied 30% in the last three years. Today, the stock still trades at a low 11 times this year’s expected earnings.

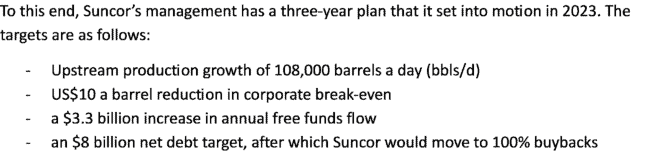

But the fact is that Suncor rallied off of lows that were hit due to Suncor’s own operational and financial flaws. Clearly, there was and is still a lot of work to do to elevate the company’s performance even higher:

2024 progress

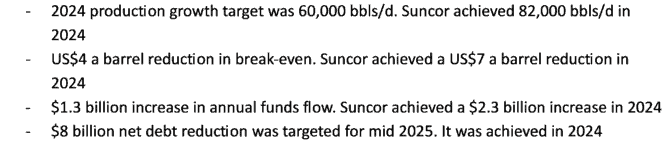

Suncor released its 2024 results back in February. The key takeaway for investors is that Suncor is breaking records, beating expectations, and delivering value. Let’s take a look at how the company performed relative to its 2024 targets (on the way to the three-year plan):

2025: Suncor to build on momentum

As you can see by comparing the company’s three-year targets to what was achieved in 2024, Suncor has come a long way. Record production, record refinery utilization, and a record safety performance have set Suncor up with great momentum for 2025 and beyond. What this means is that there may be some upside to the three-year targets that were set last year.

Right now, analyst expectations are calling for earnings per share (EPS) of $4.62 for 2025. This is below last year’s performance, but that’s a function of the commodity environment. For example, oil prices are well below what they were in 2024, and spreads are weaker as well.

But Suncor is handling the things it can control exceptionally well, as we have seen in its 2024 results. For example, total operating costs were $13.1 billion in 2024, down $324 million versus last year. Essentially, volumes were roughly 10% higher, while costs came in 2.5% lower. This is a great example of operating leverage in action.

The bottom line

Suncor has set itself up well for 2025 and beyond. The company is taking this momentum it is currently experiencing and building on it. Operating leverage will continue, and this will possibly enable Suncor to exceed its free funds flow target of $3.3 billion. Regardless, though, Suncor Energy stock should continue to perform well as the company continues to create significant value for its stakeholders.