Figuring out your dividend income is much easier when an investment has a history of steady payouts. Most stocks pay dividends quarterly, with the amount fluctuating based on earnings and board decisions. Ideally, they increase their payout over time, but there’s no guarantee.

Some exchange-traded funds (ETFs), like iShares Canadian Financial Monthly Income ETF (TSX:FIE), operate differently. FIE follows a managed distribution policy, meaning it aims to provide a consistent payout, even if underlying holdings fluctuate.

For FIE, that currently means a monthly distribution of $0.04 per share—like clockwork. Here’s what you need to know about how many shares you’d need to generate $500 in monthly income.

What is FIE?

FIE is a longstanding ETF designed to generate monthly income from a diversified portfolio of assets, mostly within the Canadian financial sector.

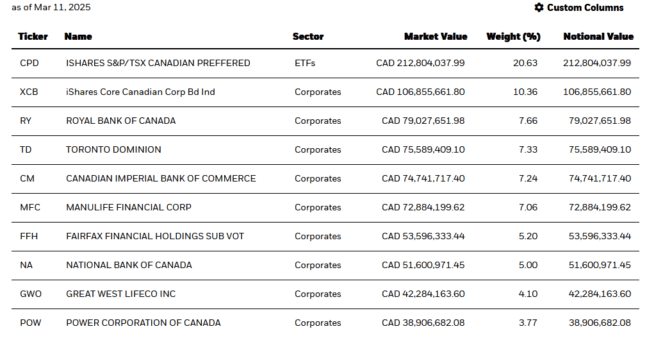

Around 70% of the portfolio is allocated to dividend-paying stocks, including Canada’s Big Six banks, major insurance companies, asset managers, and a few other financial-sector holdings like lenders and stock exchanges.

Another 20% is invested in preferred shares, which are a hybrid between stocks and bonds—paying fixed dividends but with a priority claim on earnings over common shares.

The remaining 10% is allocated to Canadian investment-grade corporate bonds, which are higher-quality debt securities issued by financially strong companies. Unlike riskier bonds, investment-grade bonds have a lower chance of default, making them a more stable income source within the ETF.

As of March 12, the ETF pays a 6% 12-month trailing yield with monthly payouts.

How much do you need to buy to earn $500 a month?

The math is simple, thanks to FIE’s steady $0.04-per-share monthly distribution. Since the payout is fixed, you can calculate exactly how many shares you need to generate $500 per month.

Each share of FIE pays $0.04 per month, which adds up to $0.48 per year ($0.04 × 12 months). To earn $500 monthly, you divide your target income by the per-share monthly payout: $500 ÷ $0.04 = 12,500 shares

Now that you know you need 12,500 shares, the next step is calculating how much that investment would cost at today’s price. As of March 11, each FIE share trades at $7.95. To buy 12,500 shares, you’d need to invest: 12,500 × $7.95 = $99,375

That means to earn $500 per month, you’d have to invest about $99,375 in FIE at its current price.

Note: If you’re not holding FIE in a Tax-Free Savings Account or a Registered Retirement Savings Plan, you’ll need to account for taxes on the distributions. In a non-registered account, part of the income may be taxed as dividends, interest, or return of capital, which can affect how much you actually take home.