Toronto-Dominion Bank (TSX:TD), or TD Bank, has given long-term investors fresh reasons for optimism following its first quarter 2025 results. Despite navigating regulatory hurdles in the United States, one of Canada’s top banks by assets is staging an impressive comeback that dividend-focused investors shouldn’t ignore.

Trading near $84 per share, TD Bank stock sits comfortably below analyst targets, averaging $91.60, suggesting a potential 8% upside over the next 12 months. More impressively, the stock has already delivered 12.7% in total returns year to date, outperforming the broader TSX index amid ongoing trade tensions.

What’s driving TD’s positive momentum? The bank’s recent earnings resilience post U.S. regulatory mishaps and plans to divest its 10.1% stake in Charles Schwab, aiming to return $8 billion to shareholders through buybacks and reinvesting the remainder into growing its business and raising investor confidence. This strategic move will boost its common equity tier-one (CET1) ratio, a key regulatory measure of bank capitalization and financial health, to 14.2%, providing ample capital flexibility for future growth initiatives.

TD Bank stock: A top dividend stock with strong fundamentals

Scale matters tremendously in banking, and TD Bank’s $2.1 trillion asset base places it neck-and-neck with Royal Bank of Canada as one of the country’s banking giants. Despite recent U.S. challenges requiring portfolio restructuring, TD’s Canadian banking operations shone brightly, helping push adjusted earnings per share up 1% year over year to $2.02 during the first quarter of 2025.

The bank stock reported record revenue in its Canadian personal and commercial banking segment for the quarter ended January 31, 2025. Strong domestic market share growth, record performance in wealth management, and resilient wholesale banking have created a solid earnings foundation. Meanwhile, five consecutive quarters of consumer deposit growth in U.S. operations help somehow offset impacts from regulatory asset caps.

Passive-income growth: A TFSA must-have

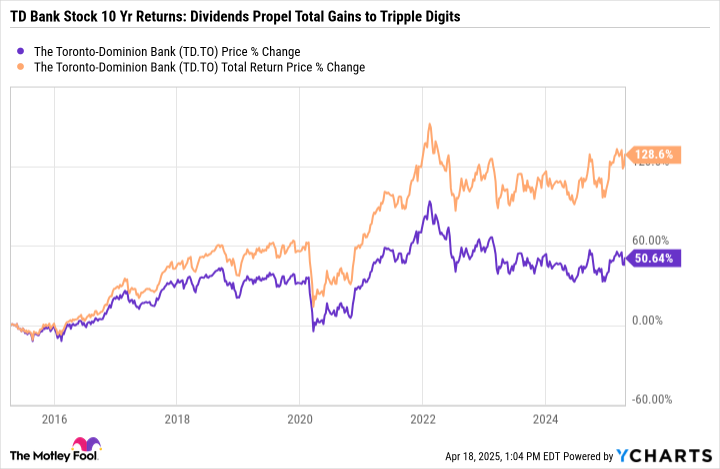

Dividends and consistent dividend reinvestment have been strong sources of shareholder returns over the past decade, lifting total investor gains from 50% to almost 130%! The new chief executive officer appears keen on sustaining TD Bank stock’s dividend-growth status.

For income-focused investors, TD Bank recently hiked its quarterly dividend by 2.9% to $1.05 per share — marking its 14th consecutive year of dividend increases. At current prices, this translates to an attractive 5% annual yield. While recent one-time charges related to U.S. regulatory issues temporarily inflated the payout ratio, analysts project earnings of approximately $8.13 per share for 2025, bringing the payout ratio down to a sustainable 51.7%.

This balanced approach means TD Bank generates sufficient earnings to both reward shareholders and reinvest in growth organically. The bank’s healthy 13.2% adjusted return on equity (ROE) combined with its roughly 50% earnings retention ratio suggests strong potential for organic capital expansion, which ultimately means greater lending capacity, improving profitability, and rising book value for TD stock.

Why the dividend-growth stock remains attractive below $90

TD Bank anticipates completing its U.S. balance sheet restructuring by mid-2025, clearing a path for renewed focus on growth initiatives. The bank’s expanding digital services adoption represents another bright spot for future operational efficiency.

At the current valuation below $90 a share, a forward price-to-earnings (P/E) ratio of 10.6 appears cheap compared to peers, and TD Bank stock offers compelling value compared to historical averages. The combination of current yield, dividend growth potential, and share price appreciation makes TD Bank worthy of consideration as a core holding in Tax-Free Savings Accounts focused on generating growing passive income over the next decade.

While economic headwinds from trade tensions and consumer confidence concerns remain valid considerations for all banking stocks, TD Bank’s strong capitalization, sustainable dividend, and strategic repositioning make it well-equipped to navigate uncertainties. For those seeking a TFSA dividend stock to hold for the long term, TD Bank offers the perfect blend of current income, growth potential, and value.