Conservative Party leader Pierre Poilievre has proposed raising the annual contribution limit for Tax-Free Savings Accounts (TFSAs) as part of his platform. His promise includes an extra $5,000 in TFSA room each year—but only for investments made in Canada. Details are still scarce, but the idea has been welcomed by many Canadians eager to build wealth faster.

That said, an election hasn’t happened yet, and nothing has changed officially. For now, the TFSA contribution limit for 2025 remains at $7,000, the same as in 2024. Here’s how I would invest that $7,000 today if my goal was long-term growth.

Buy this all-in-one ETF

When you’re investing for growth, you’re aiming for both share price appreciation and dividend income. The goal is to maximize total return—not just one or the other.

To do that effectively, I want to stay as diversified as possible. One of the best exchange-traded funds (ETFs) for that purpose is the TD Growth ETF Portfolio (TSX:TGRO).

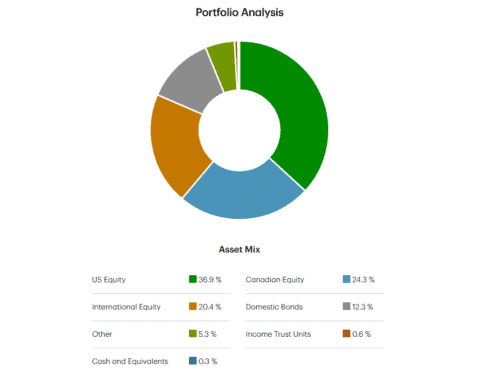

This is a fund of funds, meaning it holds four underlying TD ETFs in the following mix: 10% in the FTSE Canada Universe Bond Index, 30% in the Solactive Canada Broad Market Index, 40% in the Solactive US Large Cap CAD Index, and 20% in the Solactive GBS Developed Markets ex North America Large & Mid Cap CAD Index.

That gives you 90% global equity exposure and 10% Canadian bonds—a sensible yet aggressive asset allocation for long-term growth. TD handles all the rebalancing for you. All you need to do is periodically buy more shares and reinvest the distributions.

Why I personally like TGRO

TGRO isn’t the only all-in-one asset allocation ETF available to Canadian investors—but it’s my favourite for three key reasons.

First, the fees. With a management expense ratio (MER) of just 0.17%, it undercuts the competition from providers like iShares and Vanguard, which typically charge between 0.20% and 0.24%.

Second, it doesn’t hold emerging market stocks like those from China or India. Personally, I don’t think the added expense and volatility are worth the expected returns. Historically, emerging markets have underperformed, and I prefer to keep things simple.

Third, the distribution is paid monthly. While that makes no difference in the long run, it’s psychologically satisfying to see income roll in every month rather than quarterly or annually.