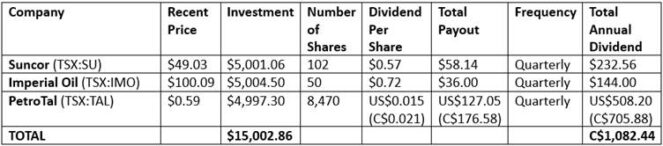

The Canadian energy sector is like a rollercoaster right now. Oil prices are swinging, tariffs are causing some headaches, and some oil stocks are soaring while others keep sinking. But for long-term investors, this volatility could be an opportunity to buy resilient companies at discounted prices. If I had $15,000 to invest in TSX energy stocks today, I’d split it equally among three Canadian energy stocks: Suncor Energy (TSX:SU), Imperial Oil (TSX:IMO), and PetroTal (TSX:TAL). Here’s why.

Suncor Energy stock and portfolio stability

Suncor is a blue-chip energy stock to buy for capital preservation, steady growth, and passive income. It doesn’t just pump oil, it refines it, sells it at Petro-Canada gas stations, and even upgrades oil sands into usable products. This “integrated” model means Suncor maintains minimal tariff exposure, and it makes money at every step of the process, whether oil prices are high or low. For example, when crude prices drop, its vast refining business often benefits from cheaper input costs.

Financially, Suncor is a fortress. It broke records during the first quarter of 2025, producing 853,200 barrels of oil per day and generating $1.5 billion in shareholder returns through juicy dividends and buybacks.

Speaking of dividends, Suncor stock’s 4.7% dividend yield translates a $5,000 investment into a $232 annual passive income stream. Even better, Suncor remains committed to share repurchases and has reduced its share count by 18.7% over five years, making each remaining share more valuable.

Suncor stock has generated over 160% in total returns during the past five years.

But what if oil stays low? Suncor has been lowering its break-even oil price (the level it needs to turn a profit and sustain dividends) for some time, with a US$7 per barrel drop reported early this year. Operations may remain profitable in a sub-US$50 oil price environment!

That safety net and its diversified operations make Suncor Energy stock a reliable anchor for a long-term portfolio.

Imperial Oil stock: The reliable dividend star

Imperial Oil is the granddaddy of Canadian energy stocks. It has paid dividends for over 130 years and has raised them annually for three decades now. Even during the pandemic, when oil prices briefly turned negative, Imperial kept paying shareholders. Today, its dividend yields a modest 3%, but there’s more to this story.

Like Suncor, Imperial is integrated. When oil prices rise, its production arm wins. When crude oil prices fall, its refineries thrive on cheaper crude inputs. This balance helped Imperial post record first-quarter 2025 earnings of $1.3 billion. The stock also looks undervalued, trading at a forward price-to-earnings-growth (PEG) ratio of 0.7 – a signal that its earnings growth potential isn’t fully priced in.

Looking ahead, Imperial is betting on renewable diesel. Its Strathcona refinery project, set to launch in mid-2025, will produce cleaner fuel and tap into growing demand for sustainable energy. Imperial Oil stock is adapting for the future.

PetroTal: The high-risk, high-reward TSX energy stock to play

Now, here’s the energy sector wildcard I could buy: PetroTal stock. This tiny $0.59−per−share energy stock is Peru’s largest publicly traded oil producer and it’s dirt cheap. Trading at just 3.7 times free cash flow, and 0.5 times tangible book value, buying PetroTal stock is like buying a dollar’s worth of assets for 50 cents.

Further, PetroTal is an ultra-high-yield dividend stock. Its US$0.015 quarterly payout yields a staggering 14% annually and could turn a $5,000 investment into a $700-per-year passive income stream. And management seems keen to sustain the payout.

But there’s a catch. PetroTal is a penny stock that’s inherently volatile and potentially speculative. However, CEO Manolo Zuniga is bullish on growth, with new projects like the Los Angeles field and Block 107 set to significantly boost annual output over the next decade. The company is growing its production in 2025, and stable or higher oil prices could help increase cash flow and profits, and sustain double-digit dividend yields.

Just remember: high dividends can be cut if oil prices substantially fall.

How to invest $15,000 in energy stock to earn $1,000 in passive income

A $15,000 investment split equally across Suncor, Imperial Oil, and PetroTal stock could generate more than $1,000 in total annual dividends, benefit from dividend raises, and potentially generate capital gains as oil prices recover.

Total dividends could average a juicy 7.2% passive income yield,