National Bank of Canada (TSX:NA) recently delivered a quarter that turned heads. With its recent blockbuster acquisition of Canadian Western Bank (CWB) finally reflected in the numbers, investors are rightly asking: Is this Canadian bank stock a smart buy for a long-term oriented portfolio today, especially looking out over the next three to five years? Let’s dive into the story unfolding at National Bank.

The $5 billion purchase of CWB, announced back in June 2024 and closed in February this year, wasn’t just another deal. It was a strategic masterstroke, significantly boosting National Bank’s presence in Western Canada — a region where it historically had less muscle. The acquisition was a significant step forward in the acceleration of the bank’s domestic strategy. The early results are promising.

National Bank of Canada: Strong core performance meets acquisition boost

National Bank of Canada is firing on all cylinders. Adjusted earnings per share (EPS) jumped 12% year over year to $2.85 for the quarter ending April 2025. Its market-leading return on equity (ROE) of 15.6% is the envy of its peers. Income before provisions for credit losses and taxes surged 34% during the past quarter! This stellar performance wasn’t just about volatile trading markets having a good run (though that helped); it reflected solid organic growth across personal, commercial, and wealth management segments.

Now, add CWB into the mix. Personal and Commercial Banking revenue soared 25% year over year (4% organically excluding CWB). Wealth Management revenue climbed 16%. The initial integration, according to management, is advancing “ahead of schedule,” particularly on cost and funding synergies. The bank has already banked $27 million in synergies this past quarter alone — a whopping 43% of its three-year target already captured annually! This early traction suggests the promised synergistic benefits of the deal are real and potentially achievable.

Capital confidence

Buying CWB did affect capitalization. The bank’s common equity tier-one (CET1) ratio, a key measure of a bank’s financial strength, has dipped slightly to 13.4% from 13.7%. However, this capitalization level remains robust, well above regulatory requirements, and high enough to keep the dividend growth spree rolling.

Management recently highlighted future potential capital relief as the bank migrates CWB portfolios onto its more advanced risk models (Advanced Internal Ratings-Based approach, or AIRB), expected mainly in 2026. While share buybacks are on hold for now, with a focus on growth and integration, a clearer capital return plan could be out by year-end.

Risks and the road ahead: Patience could pay

It’s not all smooth sailing for the National Bank of Canada. The broader economic picture holds uncertainty. Global trade tensions, high long-term interest rates, and potential impacts from tariffs are recurring themes to watch. While the bank emphasizes its “cautious approach” and “prudent provisioning,” its credit metrics, while manageable, did see some expected pressure from absorbing CWB last quarter.

The big question mark for some investors could be the bank’s stellar trading revenue — can it last? Volatile market environments, like the one seen early this year, are ideal trading environments, but performance should normalize going forward.

NA stock’s dividend delight

Income investors, take note. National Bank boasts a solid 3.5% dividend yield. More impressively, it recently announced another dividend hike in May that marked its 16th consecutive annual increase. The bank stock’s dividend payout ratio sits at a comfortable 42.2%, down from 43.2% a year ago, signalling sustainability and room for future growth. This consistent return of capital is a major plus for long-term holders.

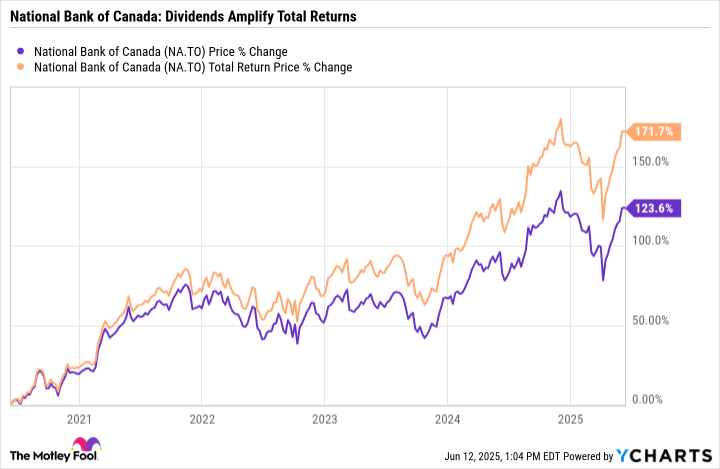

The bank stock’s dividend amplified its total returns from 123% to more than 170% during the past five years.

Is National Bank of Canada stock a buy?

So, is National Bank of Canada stock a buy now? The bank stock’s investment case looks compelling for investors with a three- to five-year horizon. Shares appear fairly valued with a price-earnings-to-growth (PEG) ratio of 0.9. The CWB acquisition brought about a strategic transformation that gives the bank a national scale and a strong Western platform in Canada. Early integration efforts are exceeding expectations, and recent organic growth exhibits the bank’s underlying strength and potential to continue growing earnings and investors’ capital.

A consistently growing dividend could amplify shareholders’ rewards.