Resilient investment portfolios take more than just tossing together a few stocks from different sectors. True defensiveness comes from deliberately focusing on factors that have historically held up well during market crashes and economic downturns.

In my case, that means prioritizing low-volatility stocks and ultra-short-term bonds. If your goal is to protect capital while still earning modest growth and income, I’ve got a three-exchange-traded fund (ETF) portfolio in mind that fits a $50,000 allocation perfectly.

The stock side

We’re putting 80% of the portfolio into stocks. That might sound high for a defensive setup, but if you’re still years or decades from retirement, equities remain your best bet for long-term growth. The key is picking the right kind of stocks—ones that are built to last when markets get rough.

To do that, we’re starting with two low-volatility ETFs: BMO Low Volatility US Equity ETF (TSX:ZLU) at 50%, and BMO Low Volatility Canadian Equity ETF (TSX:ZLB) at 30%.

Both ETFs use a rules-based strategy to screen for stocks with low beta, which is a measure of how much a stock moves relative to the broader market. A beta of one means a stock tends to move in sync with the market. A beta below one means it tends to move less, which is ideal for preserving capital during pullbacks.

Now, ZLU and ZLB don’t just look for stable price action. They also skew toward defensive sectors like utilities, healthcare, and consumer staples. These are industries that sell things people need, no matter what the economy’s doing, making their revenues and stock prices less sensitive to economic cycles.

They also throw off decent income. ZLU currently yields 1.98% and ZLB yields 2.13%, offering steady cash flow alongside stability.

The bond side

The remaining 20% of the portfolio goes into bonds, but not just any bonds. We saw in 2022 what happens when interest rates rise sharply: long-term bonds can get hammered. And if a recession hits, lower-rated corporate bonds can drop just as hard as stocks. That’s why I’m opting for BMO Ultra Short-Term Bond ETF (TSX:ZST).

This ETF focuses on debt with either a maturity or reset date within the next year, which helps shield it from interest rate swings. It primarily holds investment-grade corporate bonds, but can also include government debt, floating-rate notes, high-yield bonds, and even preferred shares.

The key point: 100% of the portfolio is investment grade, with over half (54%) rated A. That means these are high-quality issuers with low credit risk, exactly what you want for the safe side of your portfolio.

ZST is also cheap, with a 0.17% expense ratio, and it pays monthly distributions. The current yield is 2.94%, which is actually higher than the Bank of Canada’s policy interest rate of 2.75%, a nice bonus for investors looking for steady income without reaching for risk.

Putting it together

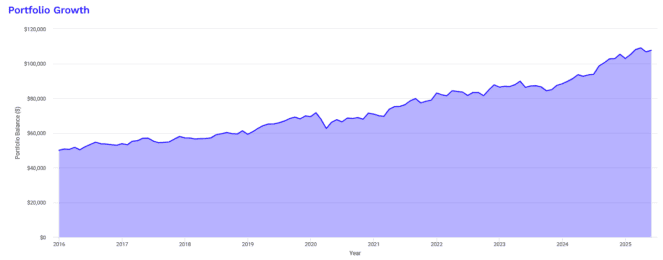

If you had invested $50,000 into this simple three-ETF portfolio back in 2016, by mid-2025, you’d be sitting on about $107,600 before taxes. That’s more than doubling your money in under a decade, with an 8.48% annualized return.

Importantly, this wasn’t done by swinging for the fences. The portfolio kept things stable. The worst year (2022) was only a 2.12% loss, and even during the COVID-19 crash, it was down just 12.66% from its peak. For comparison, many stock-only portfolios lost 30% or more during that time.

The Sharpe ratio of 0.84 and Sortino ratio of 1.38 mean that, relative to how much risk was taken, the returns were solid. These ratios tell you that you’re getting a good bang for your buck in terms of risk-adjusted performance.

In plain English: this portfolio grew steadily, didn’t panic in a crash, and delivered results that would make most investors pretty happy, especially if you value peace of mind.