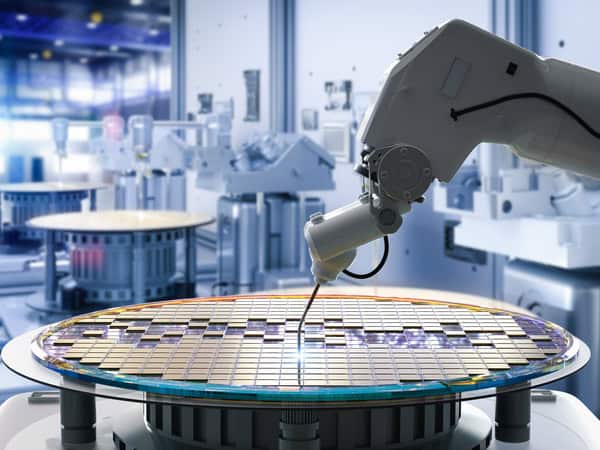

The semiconductor industry, especially specialty semiconductors, is poised for robust growth driven by several key factors. Catalysts such as the growing adoption of renewable energy sources and electric vehicles, the rise of industrial automation and space solar power sectors, and the continuous expansion of data centres are driving substantial demand for specialty semiconductors. Investing $2,000 in this industry could prove to be a strategic move, offering the potential for significant capital gains as demand continues to soar.

Within the specialty semiconductor space, 5N Plus (TSX:VNP) could be a top Canadian stock to add to your portfolio. As a leader in specialty semiconductors and performance materials, 5N+ specializes in ultra-pure materials that are integral to its various end markets. These industries include renewable energy, security, space technology, pharmaceuticals, medical imaging, and industrial applications.

Thanks to robust demand across these niche and high-growth markets, 5N Plus has consistently delivered solid financial performances, which boosted its stock price. Year to date, 5N Plus stock has surged by more than 53.5%, reflecting the company’s strong financial performance. Furthermore, over the past three years, VNP stock has delivered impressive growth of over 721%.

Despite its significant gains, 5N Plus stock has ample room for further growth. The favourable demand dynamics provide substantial momentum for future expansion, making it an attractive investment opportunity in the specialty semiconductor industry.

Why 5N Plus is a smart bet in specialty semiconductors

5N Plus is poised to deliver strong growth owing to its exposure to the high-growth markets. As the world’s leading supplier of ultrahigh-purity semiconductor materials outside China, the company sees significant demand and benefits from long-term partnerships with major players in the specialty semiconductors market.

Demand for the company’s products is booming across various sectors, including terrestrial renewable energy and space-based solar power, where 5N Plus is well-positioned to capture opportunities. The company also anticipates robust growth in imaging and sensing applications, particularly in security, defence, and medical fields. A significant growth driver in the medium term could emerge from the transition to photon counting detector (PCD) technology in medical imaging.

Financially, the specialty semiconductors segment has seen impressive momentum. In the first quarter (Q1) of 2025, the segment’s revenue reached $62.8 million, up from $45.2 million in the same quarter a year earlier, with adjusted gross margins increasing to 35% from 29.2%, supported by stronger demand, economies of scale, and higher pricing. The backlog for this segment stands at 337 days of annualized revenue, with renewable energy and space solar sectors exceeding 365 days.

The Performance Materials segment is another bright spot, driven by health and pharmaceutical markets, which offer stable cash flows and high margins. Q1 2025 revenue climbed to $26.1 million, compared to $19.9 million in Q1 2024, with a backlog representing 102 days of annualized revenue.

Looking ahead, the company’s expanded production capacity and greater operational flexibility position it well to capitalize on organic growth opportunities. Moreover, strategic acquisitions will likely accelerate its growth.

These factors, combined with its leadership in specialty markets, suggest that 5N Plus shares could see sustained upward momentum in the coming years.