Dividend investing offers many benefits for investors. Firstly, dividend stocks provide reliable, and preferably growing dividends over time. This supplements our income and puts cash in our pockets at regular intervals. Also, dividend stocks are typically more established and less risky.

In this article, I’ll discuss Tourmaline Oil Corp. (TSX:TOU), a Canadian dividend stock that has an exemplary record of both reliable and growing dividends.

Tourmaline shows us the power of being the leading natural gas producer

How many stocks do you know that have had increasing dividends and special dividend payments in the last few years? It might surprise you to find out that Tourmaline has been doing just that. I mean, it is quite impressive that a commodity stock has been able to achieve the type of dividend stability and growth that Tourmaline has.

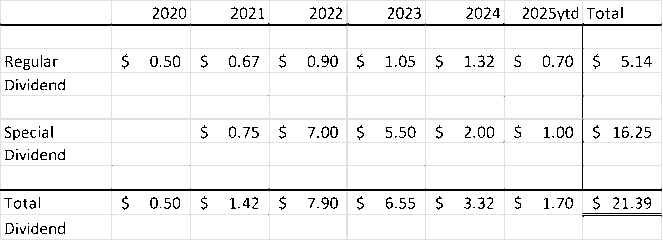

Let me illustrate this for you. In the chart below, I have listed all regular dividend and special dividend payments since 2020.

As you can see from the chart, Tourmaline has paid out $5.14 per share in regular dividends and $16.25 in special dividends. This amounts to a total of $21.39 per share in dividends in this time period.

The key takeaway is pretty simple: Tourmaline has created an extremely robust natural gas business, with strong cash flows, earnings, and growth.

Tourmaline: A natural dividend-growth story

As Canada’s largest and lowest-cost natural gas company, Tourmaline’s business is well-suited to pay out dividends. This is because the company makes money even at depressed natural gas prices because its costs are so low and because it has diversified into premium markets. It’s also because the Canadian natural gas industry is growing at a rapid pace.

In 2024, Canadian natural gas prices were at a low of $1.45 per gigajoule. This was down from 2.74 in 2023 and represented a tough year. Despite this, Tourmaline reported earnings per share (EPS) of $3.51 and free cash flow of $1 billion. This was due to organic growth, acquisitions, and margin growth.

In its most recent quarter, this strong growth continued. In fact, Tourmaline reported a first-quarter 2025 cash flow of $963 million, which was 11% higher than the same period last year. This was the result of an 8% increase in production as well as higher realized pricing. For example, the company’s realized natural gas price increased 14% to $4.30 per million cubic feet (mcf).

Looking ahead, Tourmaline’s story continues to look bright. We can expect rising natural gas prices over the next few years as liquified natural gas (LNG) is increasingly exported out of Canada, thereby creating more demand. Also, natural gas continues to fuel the drive toward electrification and the movement away from coal.

The bottom line

Over the last few years, Tourmaline has really emerged as a top Canadian natural gas player and a top dividend payer. As we head into the next few years, I expect the company’s growth to continue strongly. This growth will translate into continued dividend growth and shareholder value creation for Tourmaline stockholders.